Forecast your startup

Financial model templates for forecasting growing companies, with expert support and custom modeling assistance if desired.

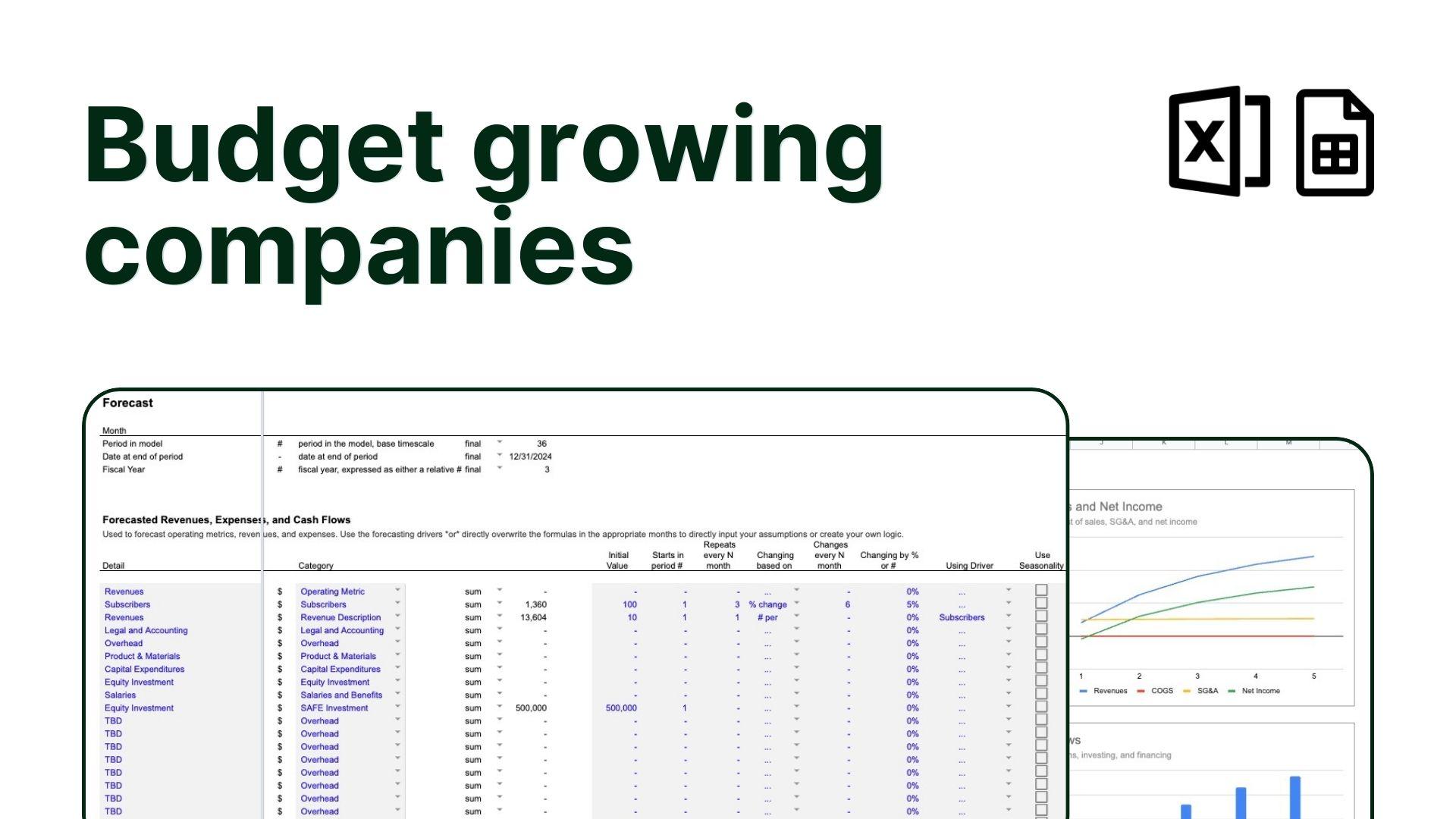

Standard Financial Model

for all revenue types

Five year financial model template for Excel or Google Sheets with prebuilt three statements - consolidated income statement, balance sheet, and statement of cash flows - and key charts, summaries, metrics and analyses prebuilt for SaaS, ecommerce, marketplaces, hardware, and many other types of businesses, with the flexibility to add any revenue model.

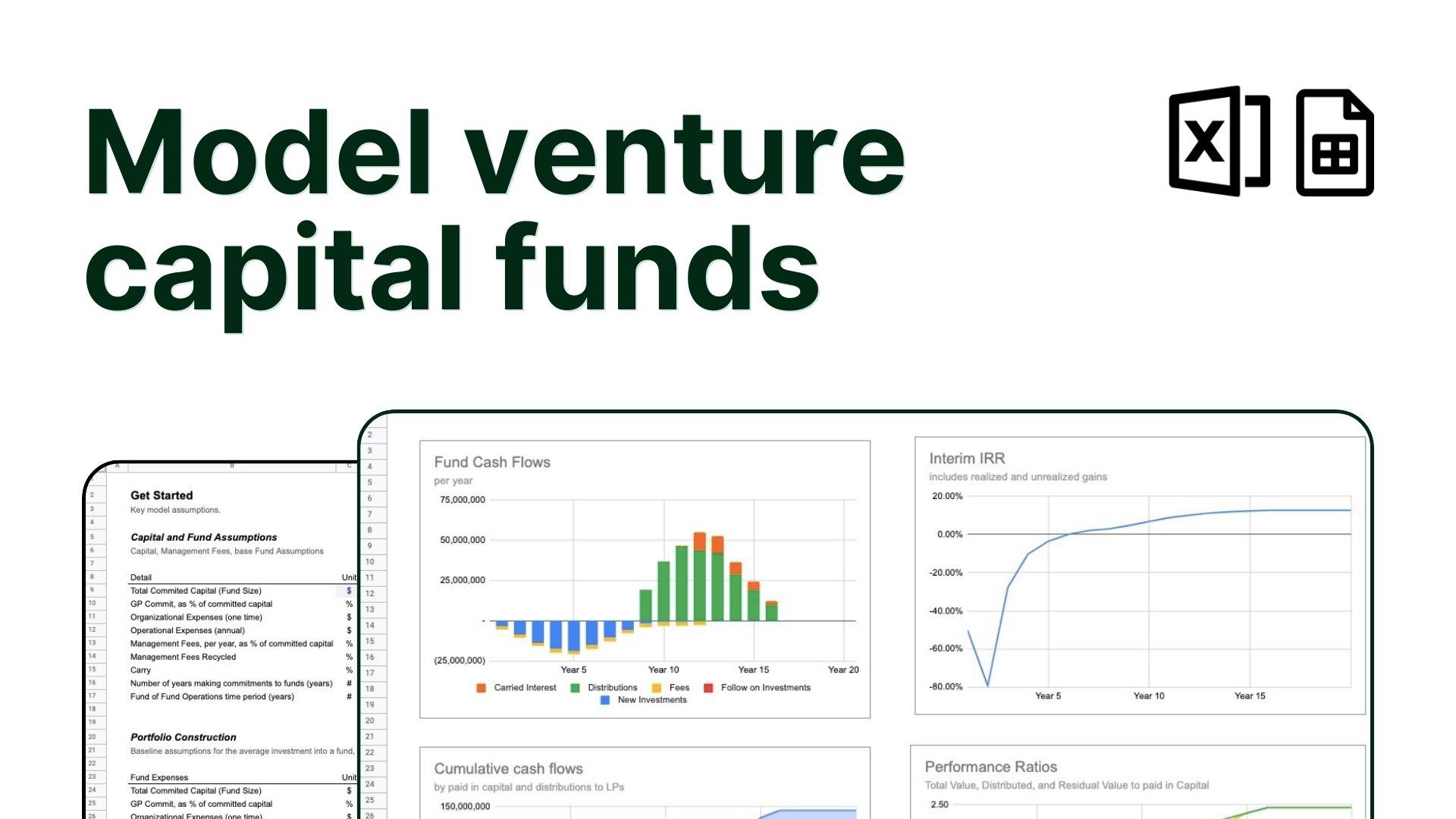

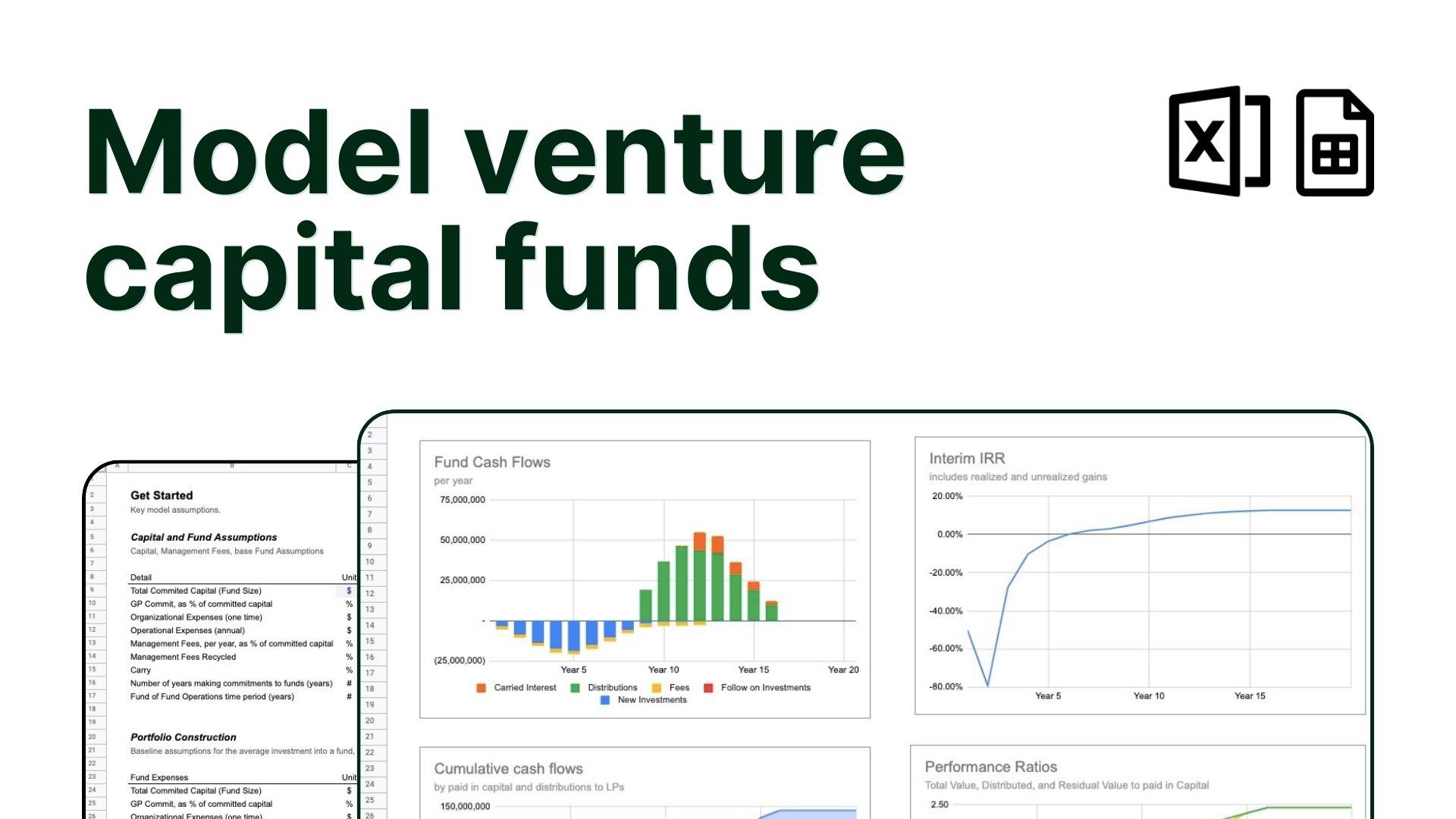

Venture Capital Model

comprehensive model

Comprehensive financial model template to forecast investments, proceeds, cash flows, and performance metrics for a venture investment strategy. Forecast initial and follow-on investments across multiple rounds, graduation rates, dilution, and exits to create a detailed view of the average investment economics. Prebuilt fund financial statements, LP and GP economics, management company budgeting, IRRs, MOICs, DPI, RVPI, TVPI, and other key fund performance metrics. Creates a quarterly forecast of primary fund cash flows and metrics for up to three scenarios.

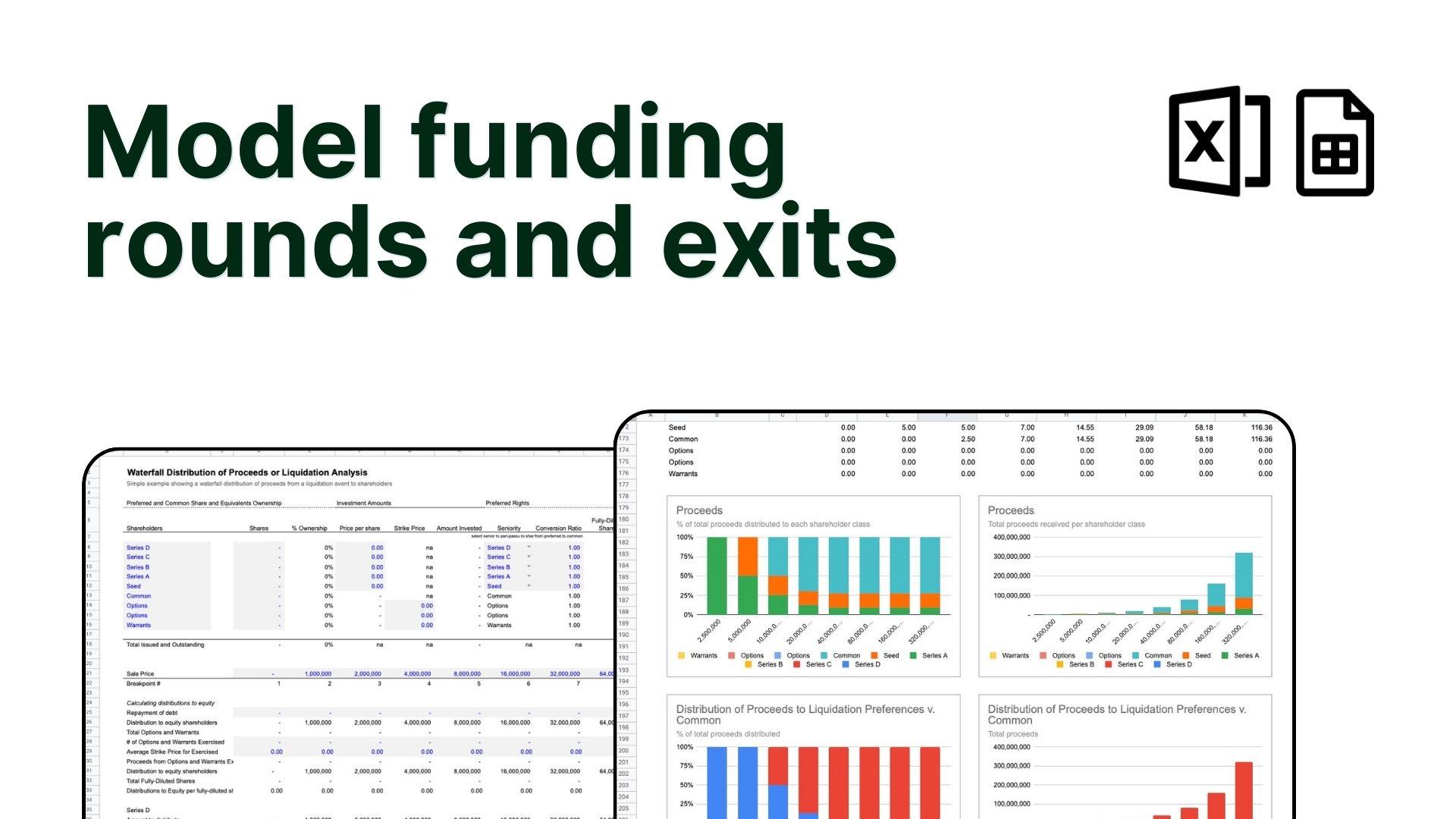

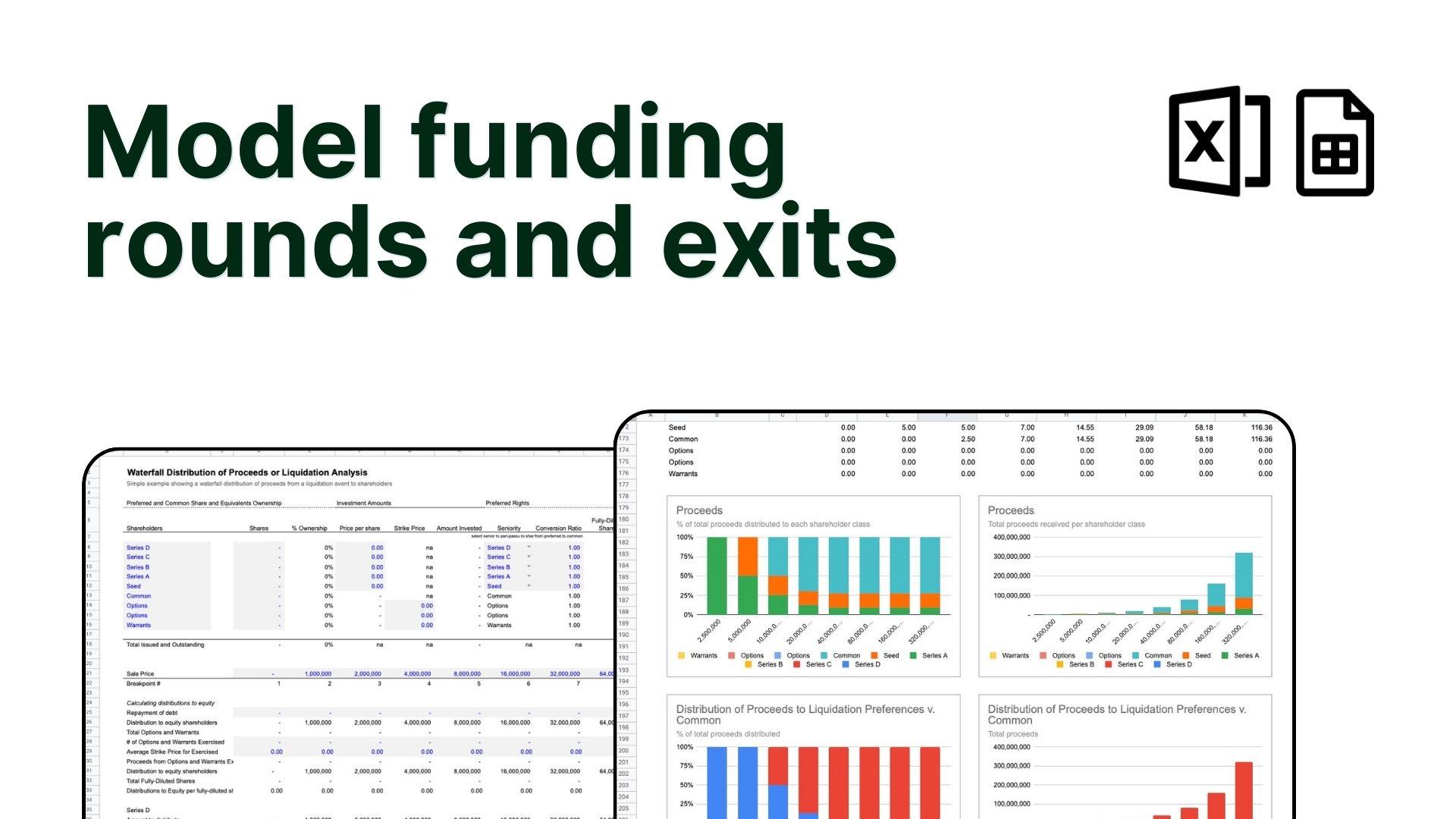

Cap Table and Exit Waterfall Tool

open cap table and waterfall

Financial model template to create a capitalization table through multiple rounds of investments via equity, SAFEs, and convertible notes, and forecast how investment rounds impact ownership, dilution, valuations, and distribution of proceeds to entrepreneurs and investors through a detailed exit waterfall.

Runway Budgeting Tool

for seed stage companies

Three year financial model template to plan your expenses, create a cash budget and forecast runway. Prebuilt consolidated three statement model - income statement, balance sheet, and statement of cash flows - and key charts and summaries.

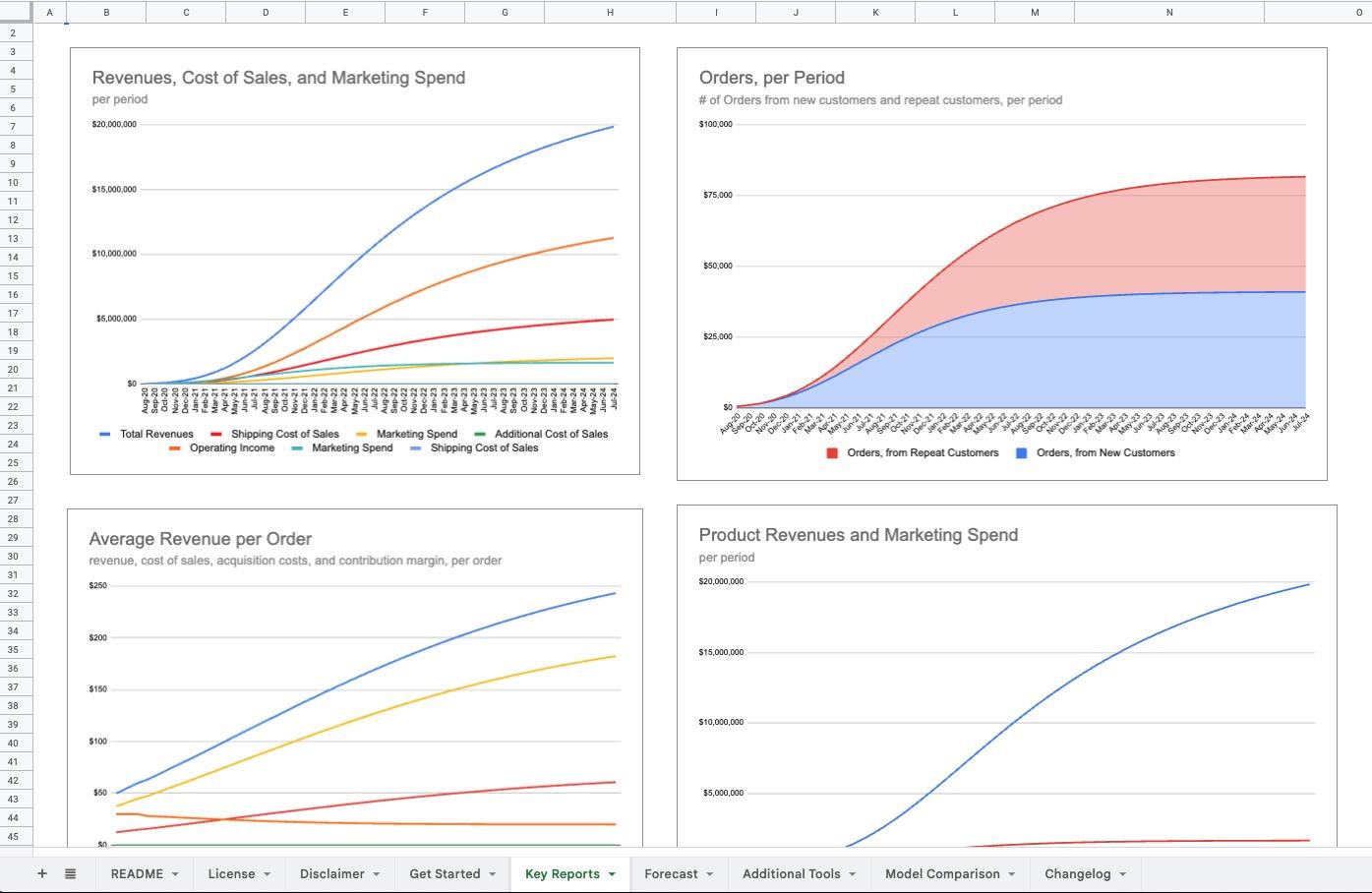

Ecommerce Forecasting Tool

revenue model only

Financial model template for ecommerce businesses. Operational assumptions - growth rate, repeat transaction rates, average revenues per order, customer acquisition costs - to create a revenue forecast plus key reports, including CAC, LTV, CAC payback period and more.

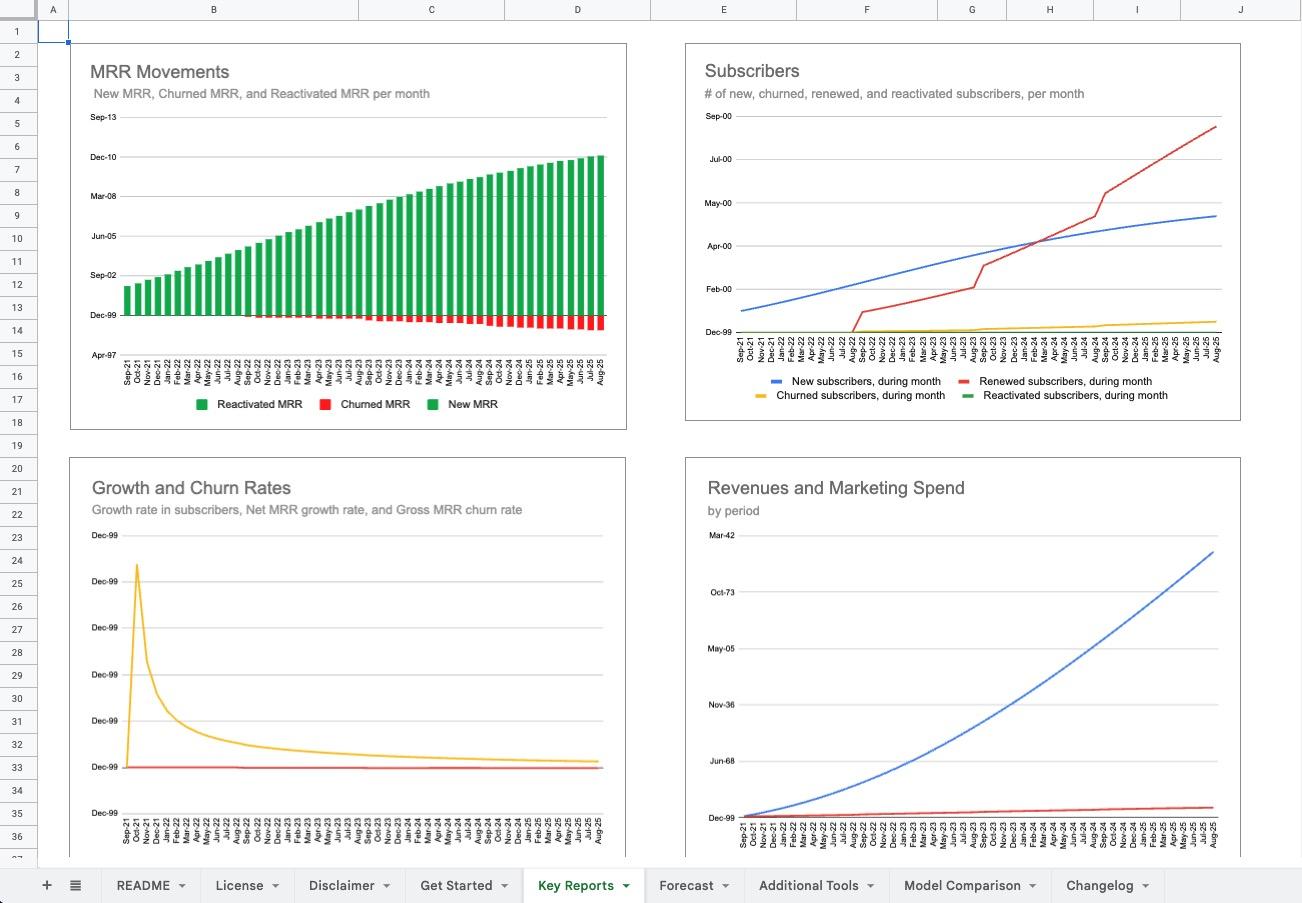

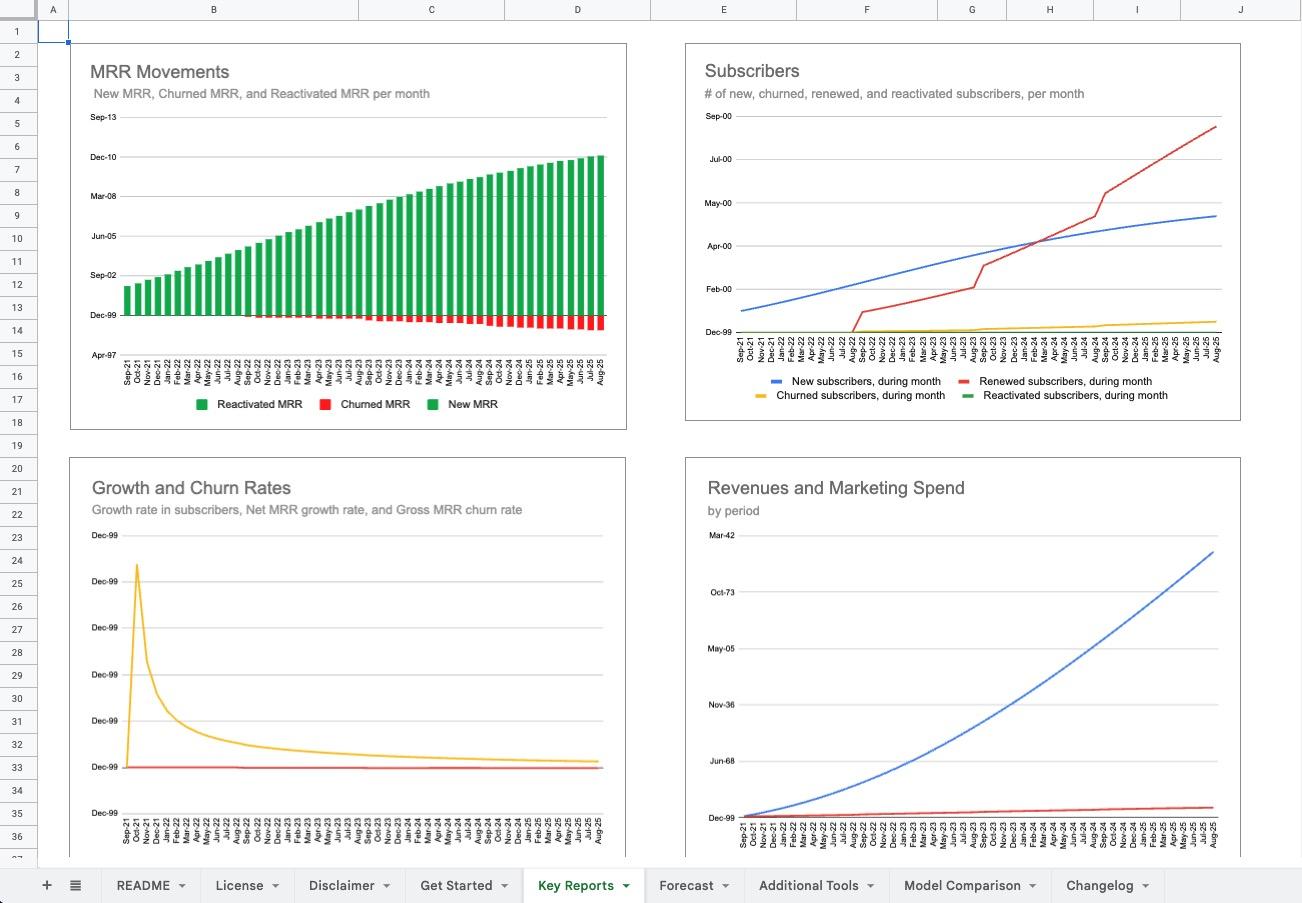

SaaS Forecasting Tool

revenue model only

Financial model template for a SaaS or subscription business for consumer, SMB, midmarket, or Enterprise SaaS. The model uses operational assumptions - growth rates, churn rates, average subscription, and more - and creates a revenue forecast plus SaaS reports such as MRR and ARR.

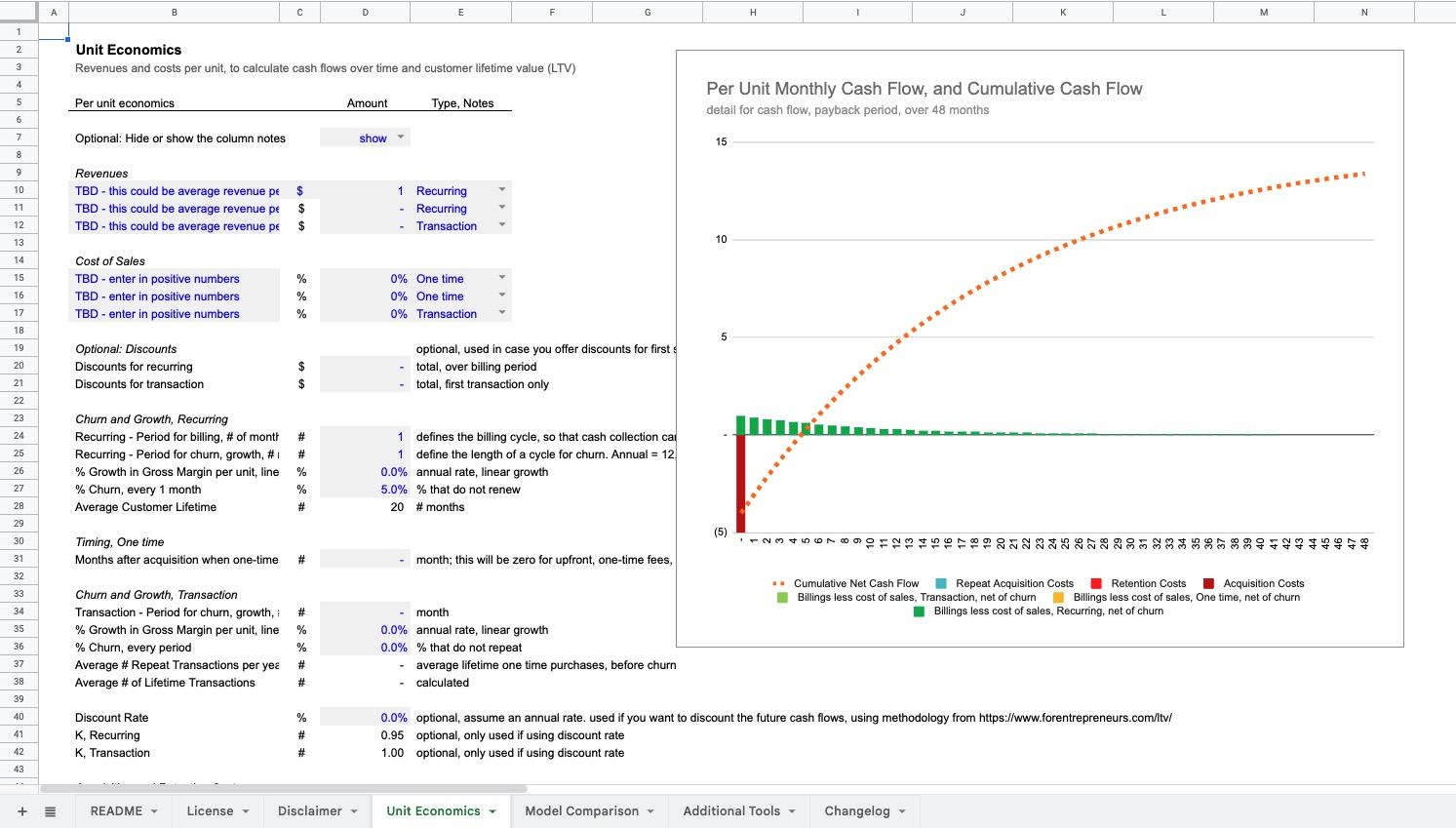

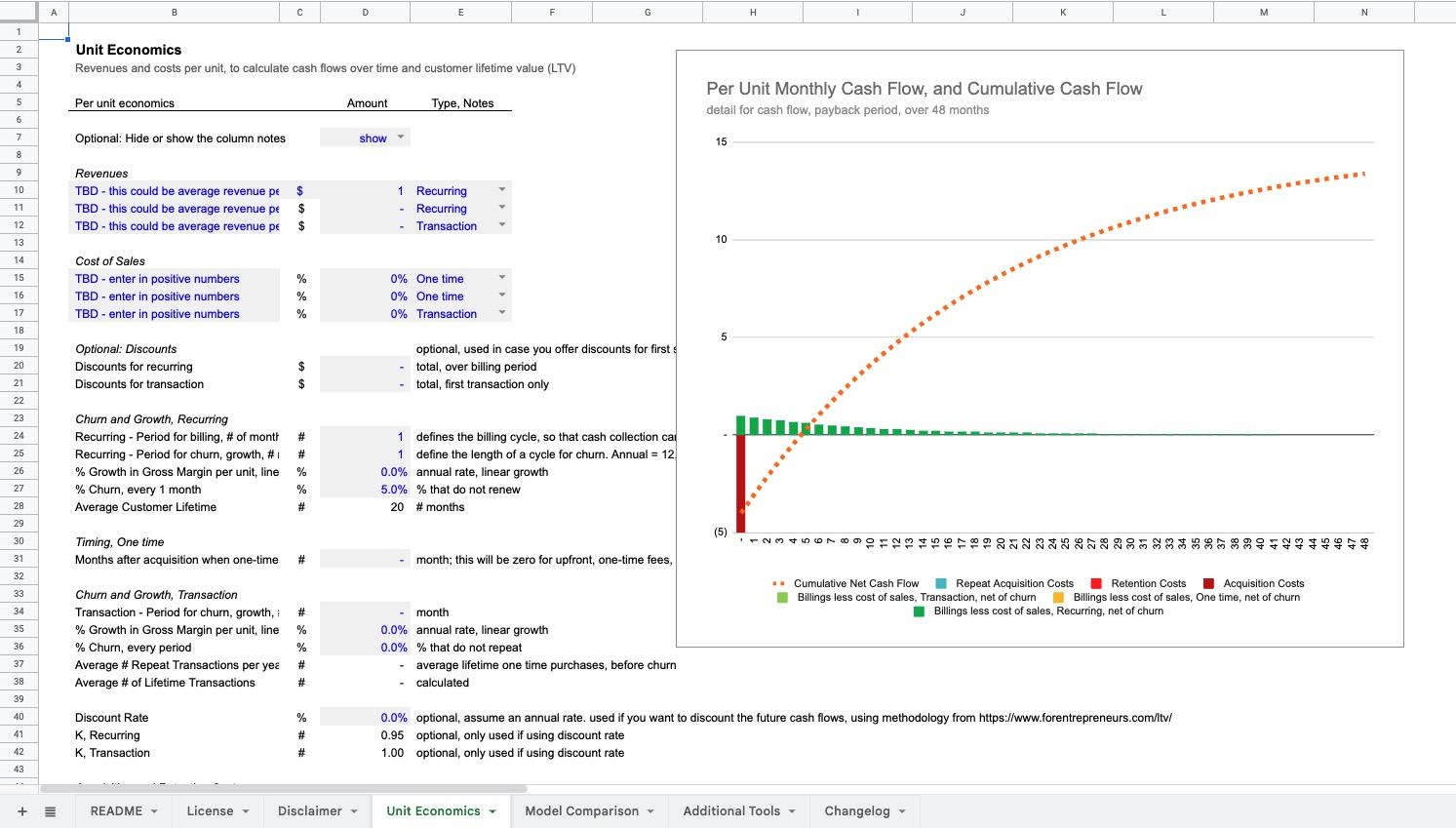

Unit Economics Tool

for per-customer analysis

Analyze fundamental unit economics by calculating margins, breakeven, and LTV (lifetime value, or customer lifetime value) based on inputs of recurring and transaction (one-time) revenues and cost of sales, churn rates, customer lifetime, and more.

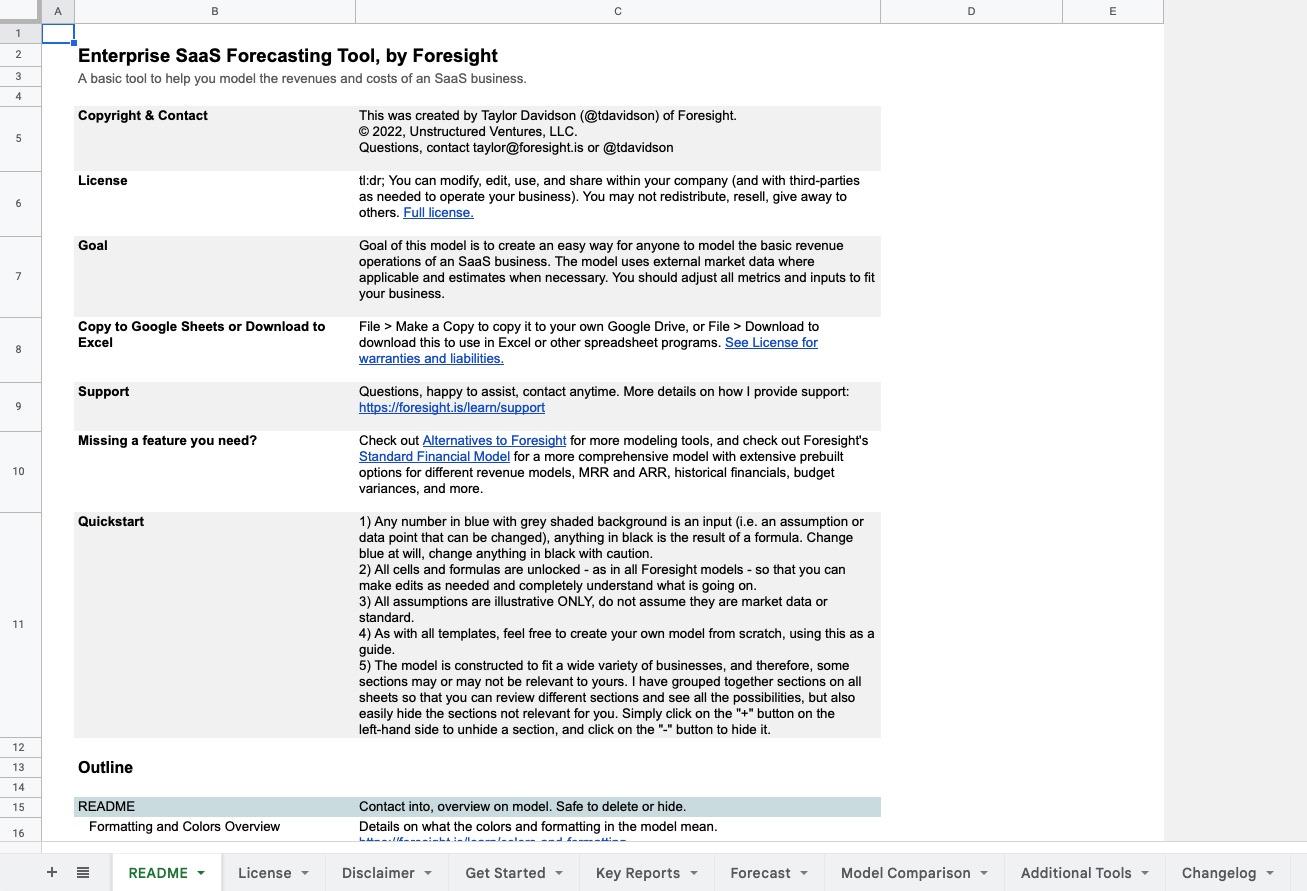

Enterprise SaaS Forecasting Template

pipeline revenue forecast

Forecast an Enterprise SaaS, subscription, services, or consulting business by detailing a specific set of customers and contracts using an sales pipeline approach, to calculate bookings, billings, revenues and more.

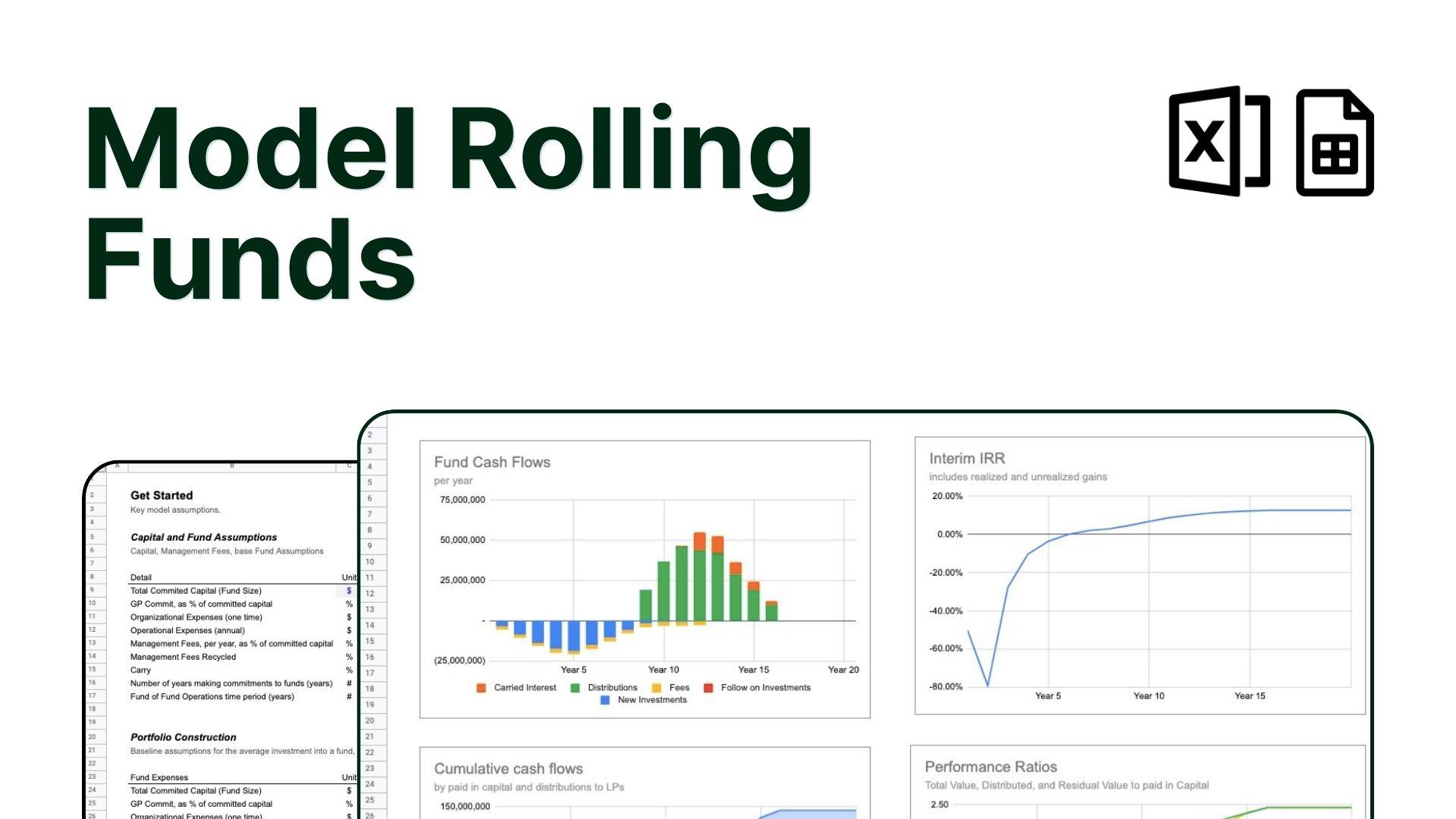

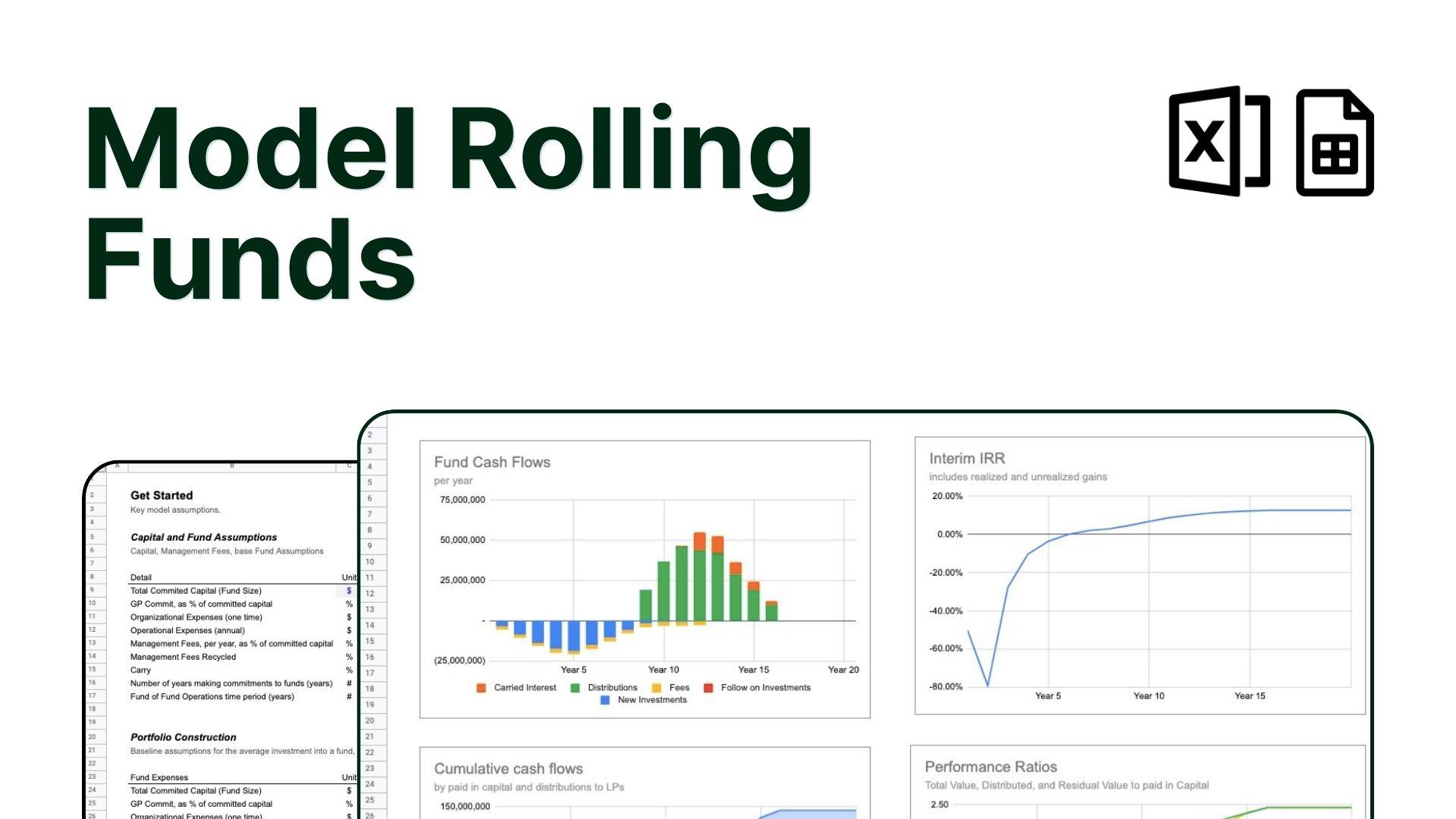

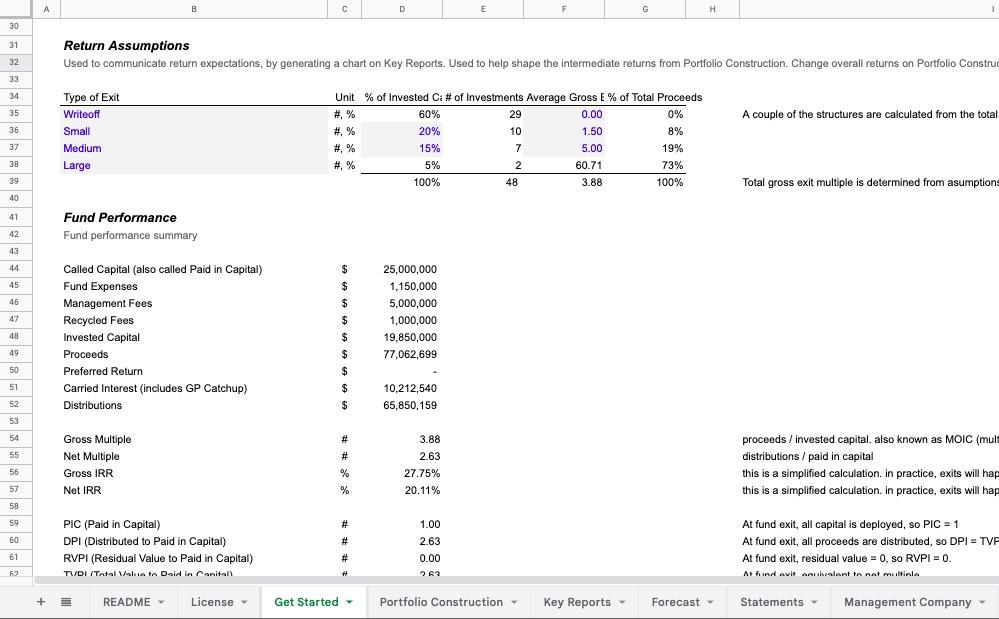

Venture Capital Model, Rolling Funds

rolling funds specific

Simplified model for forecasting a Rolling Fund, to help understand overall venture fund assumptions and how portfolio construction impacts returns. Creates a quarterly and annual forecast of primary fund cash flows and metrics, as well as overall portfolio details.

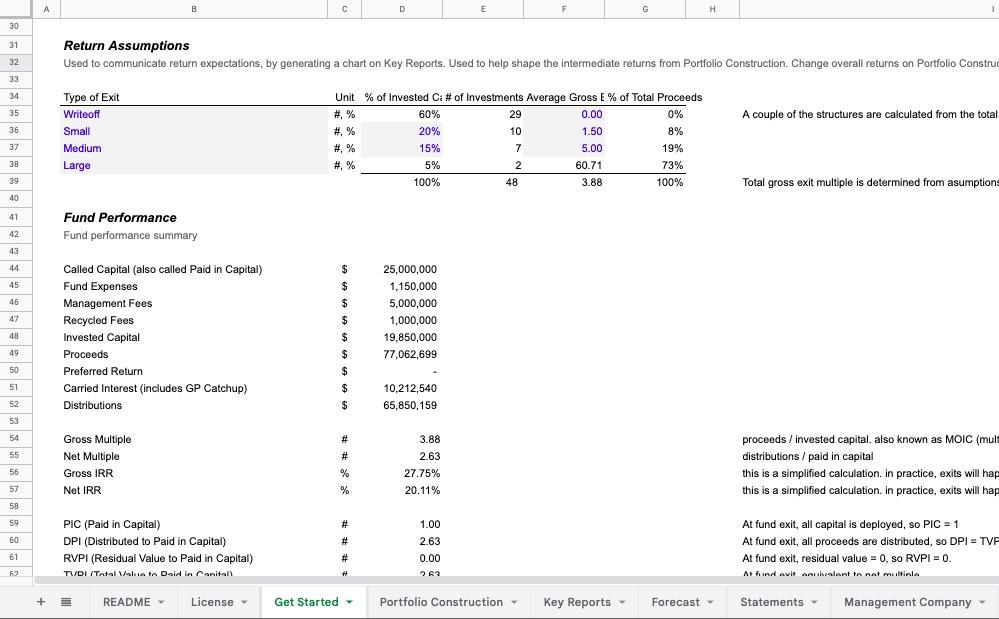

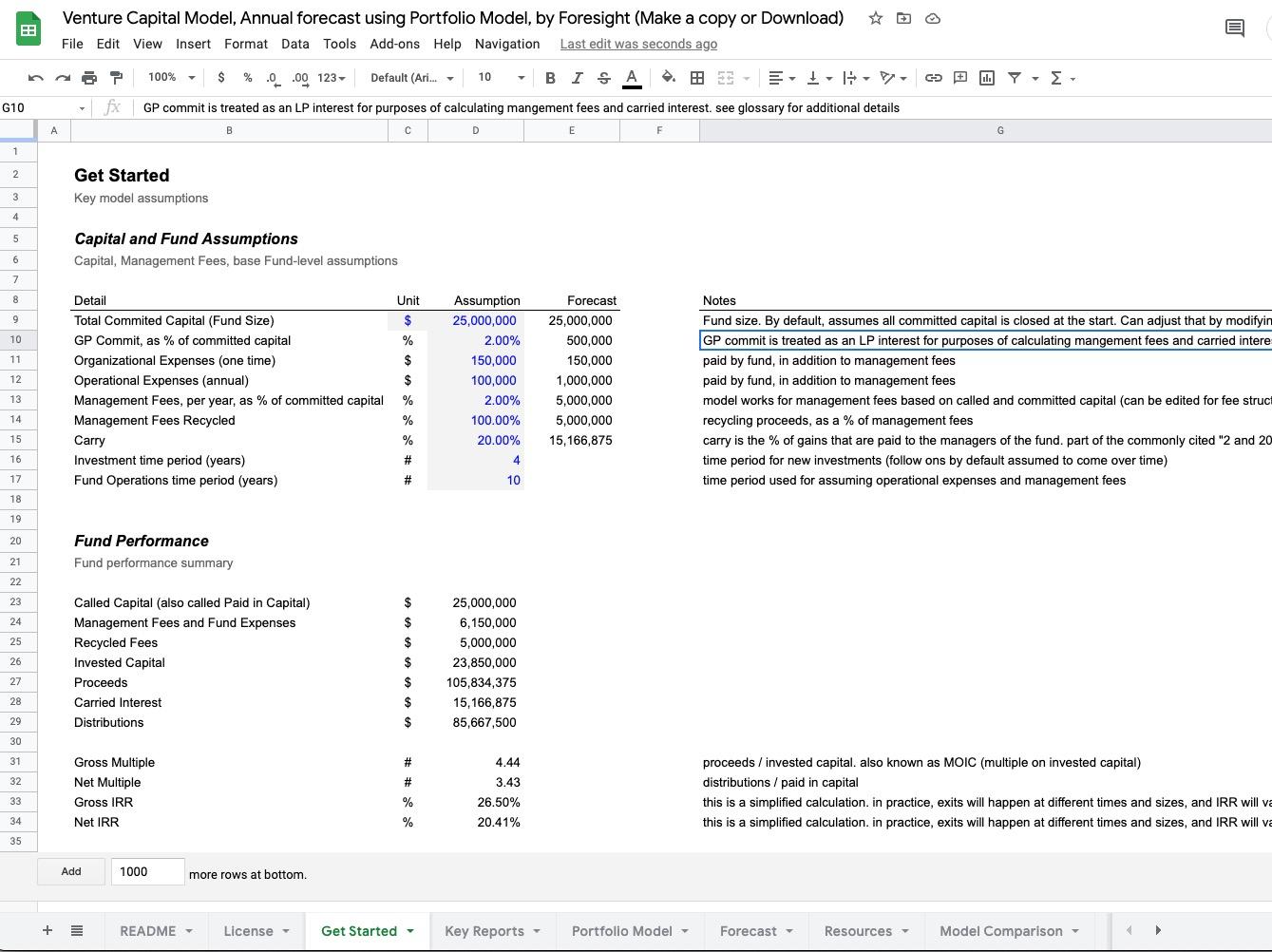

Venture Capital Model

simple annual forecast

Simplified model for forecasting a venture fund, to help understand overall fund assumptions and how portfolio construction impacts returns. Creates an annual forecast of primary fund cash flows and metrics, as well as overall portfolio details.

Venture Capital Model

manual investment input

Track historical and forecasted investments for an investment fund. Input specific or forecasted investments, follow-ons, valuation markups, writeoffs, and proceeds from exits. Creates an annual report of primary fund cash flows and metrics and overall portfolio performance.

Venture Capital Model

overall forecast

Simple model for forecasting overall returns of a venture fund, to help understand overall fund assumptions and returns. Forecast total management fees and expenses to understand total invested capital. Basic approach to portfolio construction, creates a forecast of overall returns and multiple on invested capital. No forecast of cash flows, investments or proceeds over time.

Fund of Funds Model

Model for forecasting a fund investing in venture funds, to help understand overall fund assumptions and how portfolio construction impacts returns. Creates an annual forecast of the cash flows and return multiples, IRR, and standard fund performance metrics.

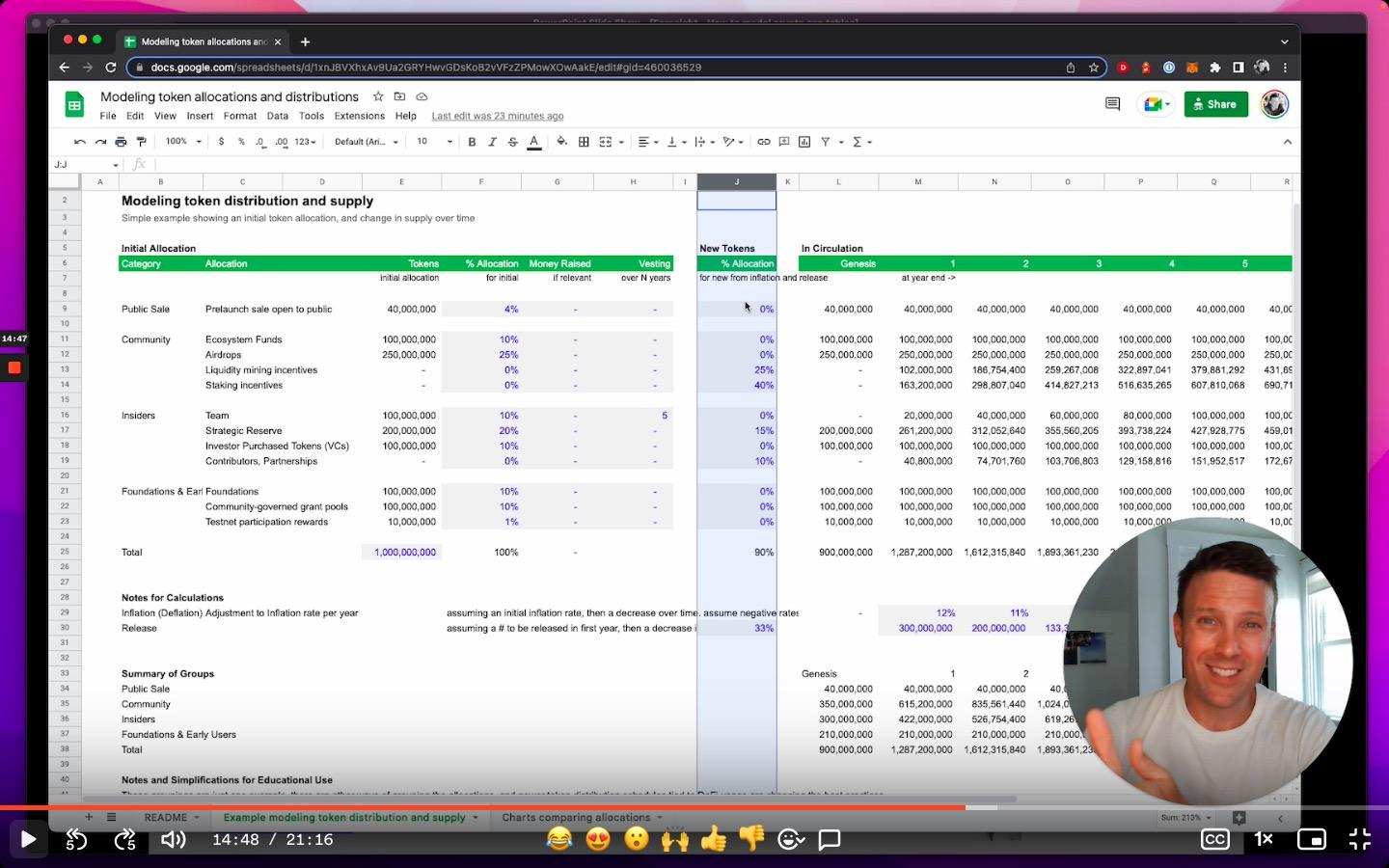

Token Allocation and Distribution Model

simple token analysis

Simple model to help translate tokenomics into a forecast of token allocations and supply over time.

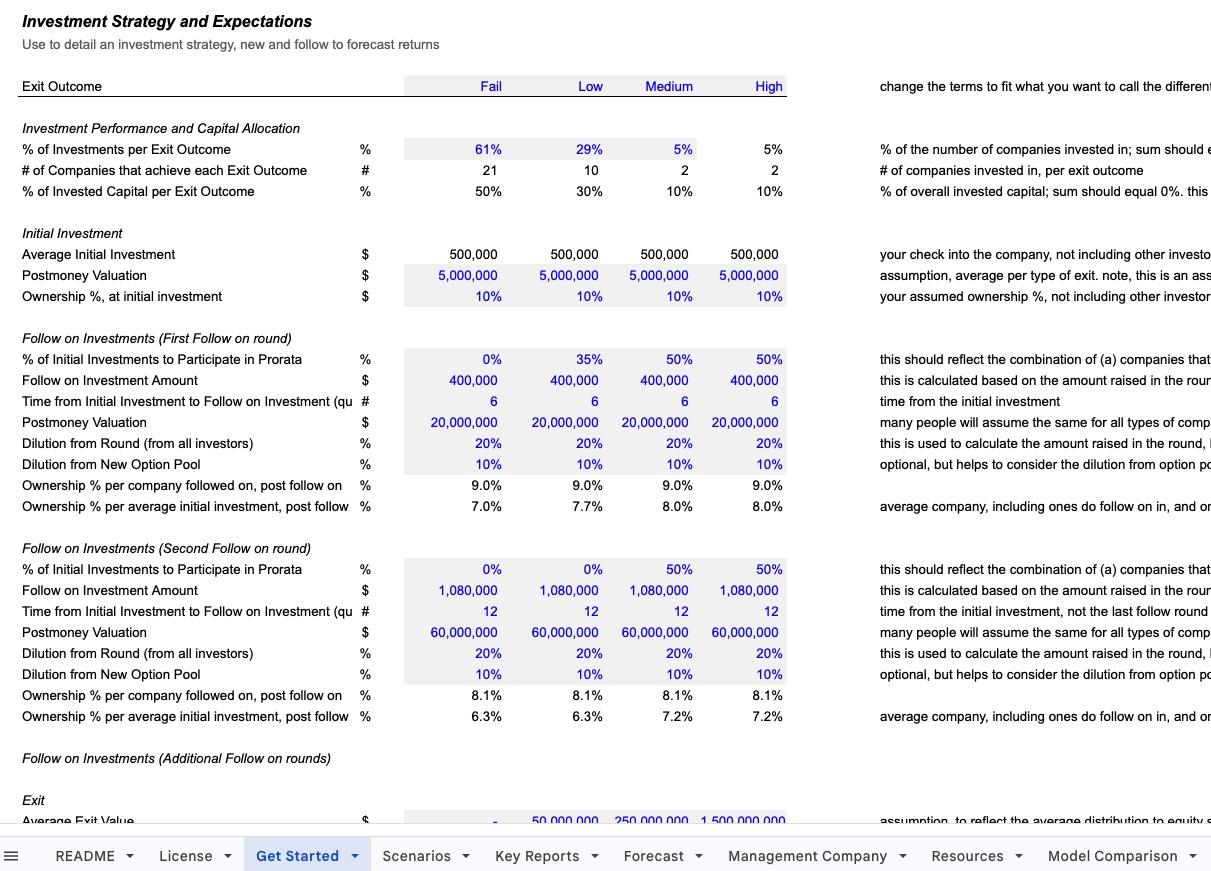

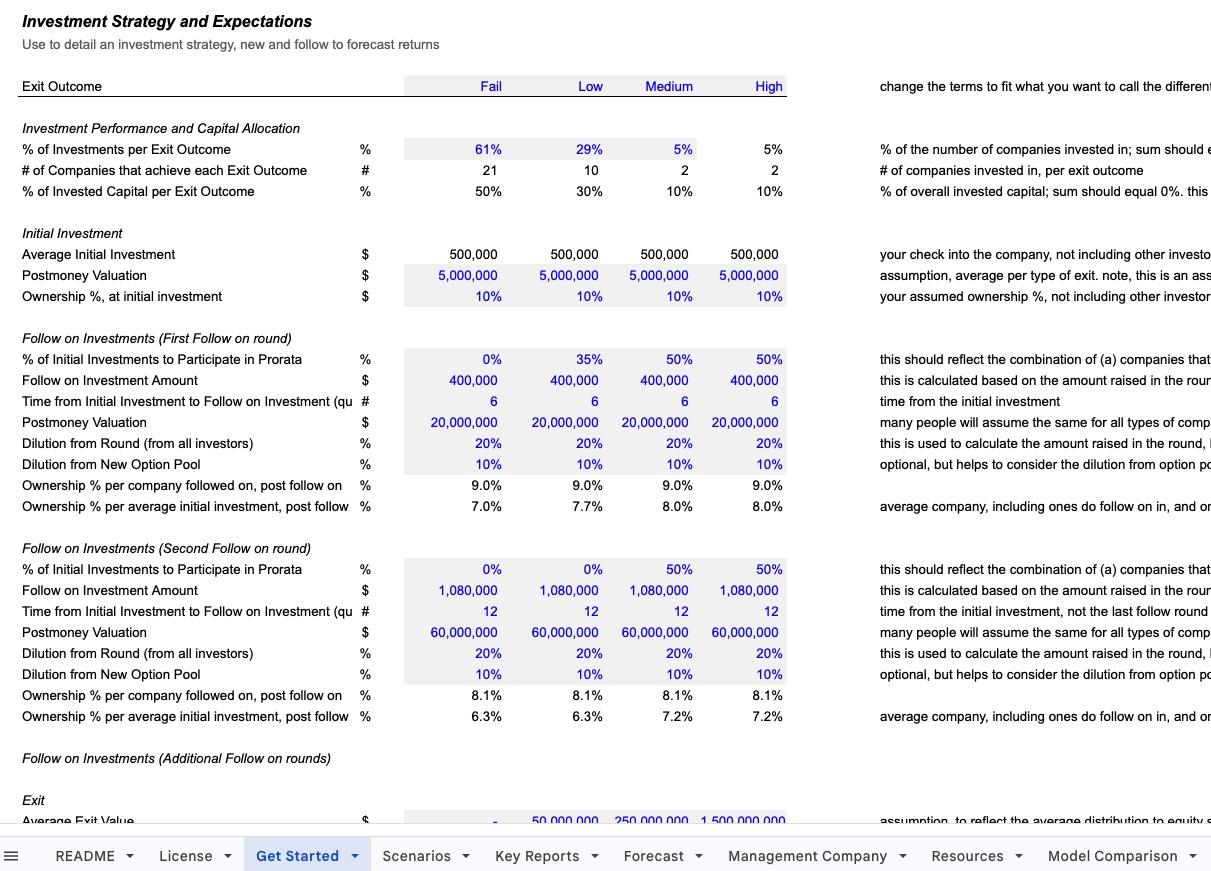

Venture Valuation Tool

per investment analysis

Analyze venture investment opportunities by modeling potential investment rounds (via equity, convertible notes, premoney and postmoney SAFEs), dilution, graduation rates, exit valuations, and likelihood of exit at multiple exit prices to analyze valuations, portfolio construction, investor returns, and more.

Venture Capital Model

quarterly forecast

Simplified model for forecasting a venture fund, to help understand overall fund assumptions and how portfolio construction impacts returns. Creates a quarterly forecast of primary fund cash flows and metrics, as well as overall portfolio details for up to three scenarios

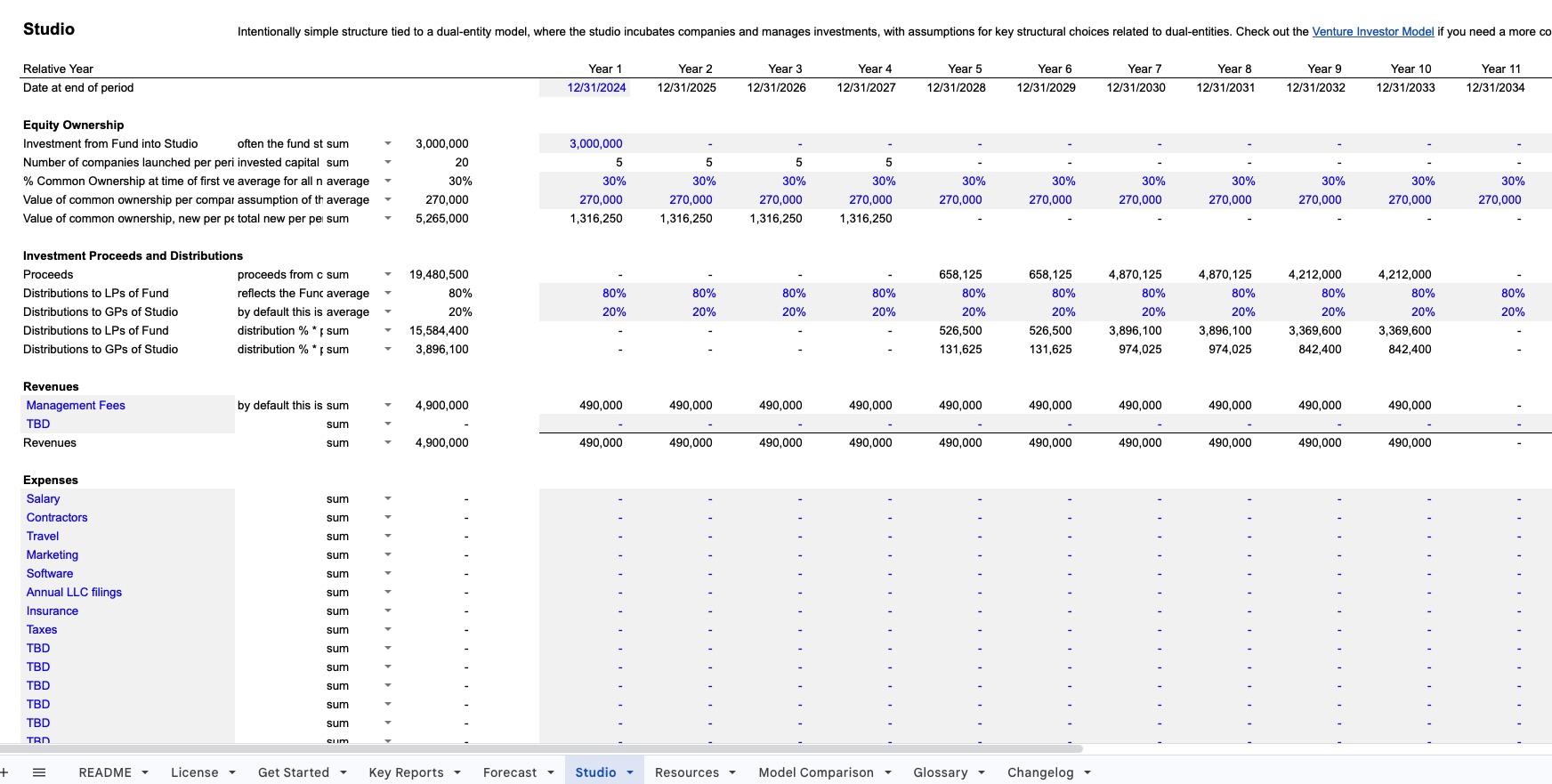

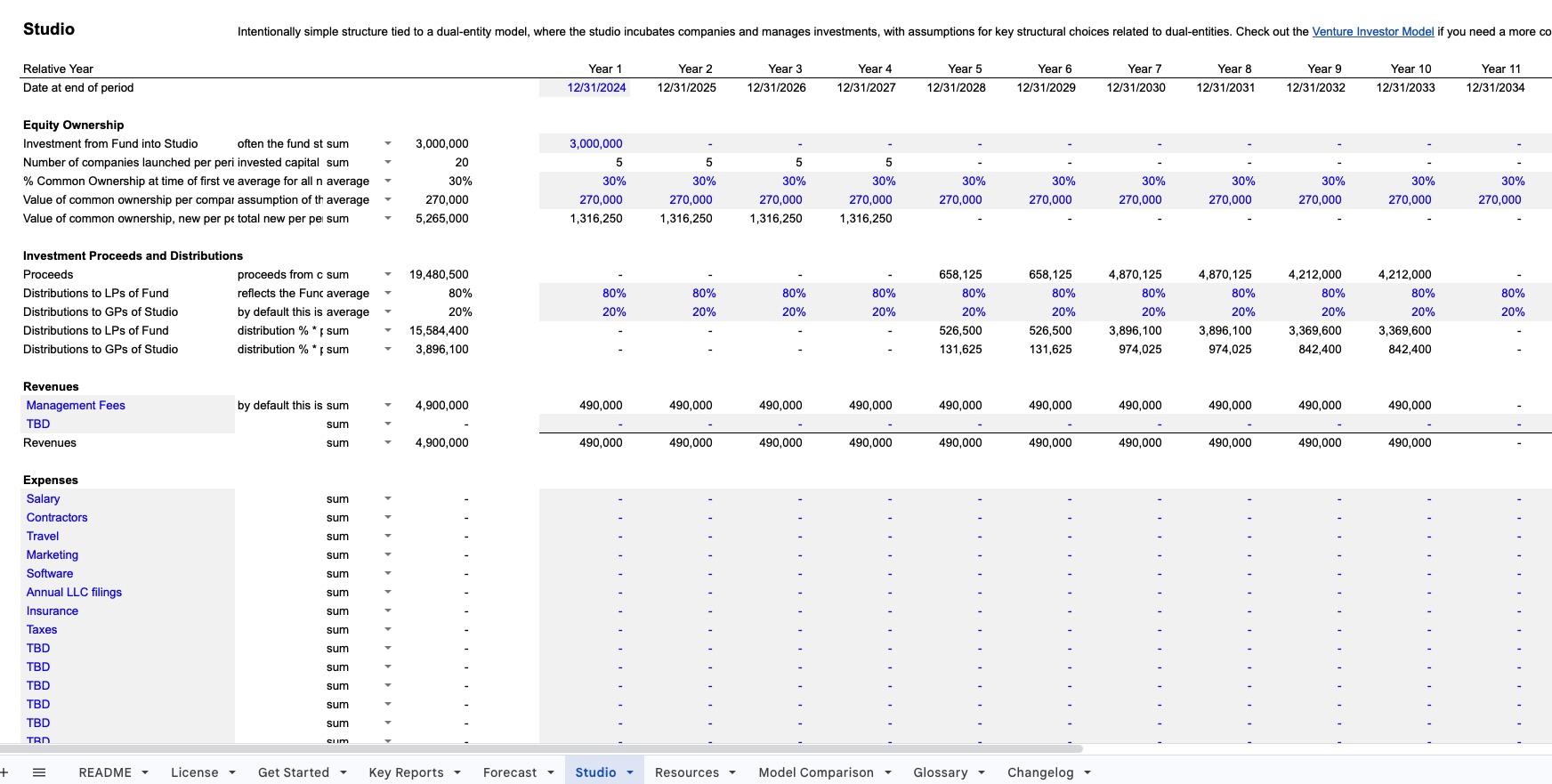

Venture Studio Model

studio plus fund

Simplified model for forecasting a venture studio using the dual-entity studio plus fund structure, to help understand overall fund assumptions and how portfolio construction impacts returns. Creates an annual forecast of primary studio cash flows and fund cash flows and metrics, as well as overall portfolio details.

Get Started Services

1 Hour Onboarding

Leverage your Foresight model and be prepared for business planning and investor conversations. Priority onboarding support, customization, and review of your financial model, based on my experience in reviewing thousands of financial models created by startups through Series B companies over the past decade. 1 hour screenshare or call, to review and edit your model.

Custom Models

for fundraising and budgeting

Custom services on a per-hour or per-project basis for complex financial modeling needs. I've built custom models for hundreds of clients since 2005 across a wide range of businesses, from ecommerce, SaaS, advertising, digital media, content, media, retail, gaming, in-app businesses, investment funds, and more, varying from pre-Seed, Seed and Series A funded startups to mature multi-million dollar businesses.

Access CFO

for Venture Investors

Strategic financial and operational guidance for venture investors without the full-time or fractional commitment. Get CFO-level expertise for your emerging fund on a flexible quarterly basis.

How to Model Venture Funds

self-paced course

6 hour self-paced course for angels, syndicate leads, and venture investors to learn how to model venture capital funds. Self-paced course, immediate access to course recordings, slides, instructional spreadsheets and extra videos

Cap Table and Exit Waterfall Course

self-paced course

9 hour self-paced course for founders, investors, and lawyers to learn the structures and math behind building cap tables and exit waterfalls. Immediate access to watch the course recordings and access instructional slides and spreadsheets. Also available as a <a href="/cap-table-masterclass/">cohort-based, live session masterclass</a>.

Forecast your startup

Financial model templates for forecasting growing companies, with expert support and custom modeling assistance if desired.

Standard Financial Model

for all revenue types

Five year financial model template for Excel or Google Sheets with prebuilt three statements - consolidated income statement, balance sheet, and statement of cash flows - and key charts, summaries, metrics and analyses prebuilt for SaaS, ecommerce, marketplaces, hardware, and many other types of businesses, with the flexibility to add any revenue model.

Venture Capital Model

comprehensive model

Comprehensive financial model template to forecast investments, proceeds, cash flows, and performance metrics for a venture investment strategy. Forecast initial and follow-on investments across multiple rounds, graduation rates, dilution, and exits to create a detailed view of the average investment economics. Prebuilt fund financial statements, LP and GP economics, management company budgeting, IRRs, MOICs, DPI, RVPI, TVPI, and other key fund performance metrics. Creates a quarterly forecast of primary fund cash flows and metrics for up to three scenarios.

Cap Table and Exit Waterfall Tool

open cap table and waterfall

Financial model template to create a capitalization table through multiple rounds of investments via equity, SAFEs, and convertible notes, and forecast how investment rounds impact ownership, dilution, valuations, and distribution of proceeds to entrepreneurs and investors through a detailed exit waterfall.

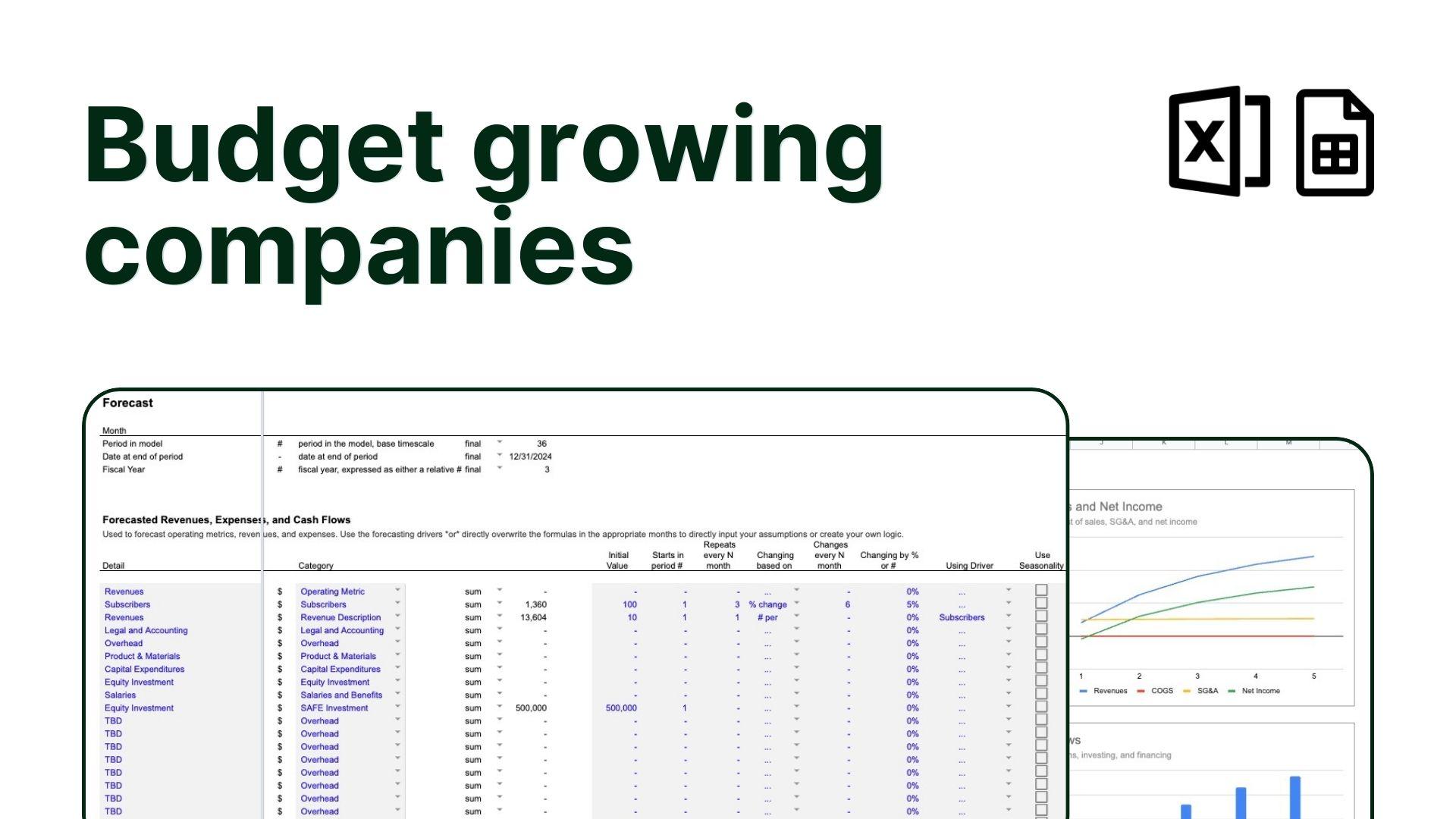

Runway Budgeting Tool

for seed stage companies

Three year financial model template to plan your expenses, create a cash budget and forecast runway. Prebuilt consolidated three statement model - income statement, balance sheet, and statement of cash flows - and key charts and summaries.

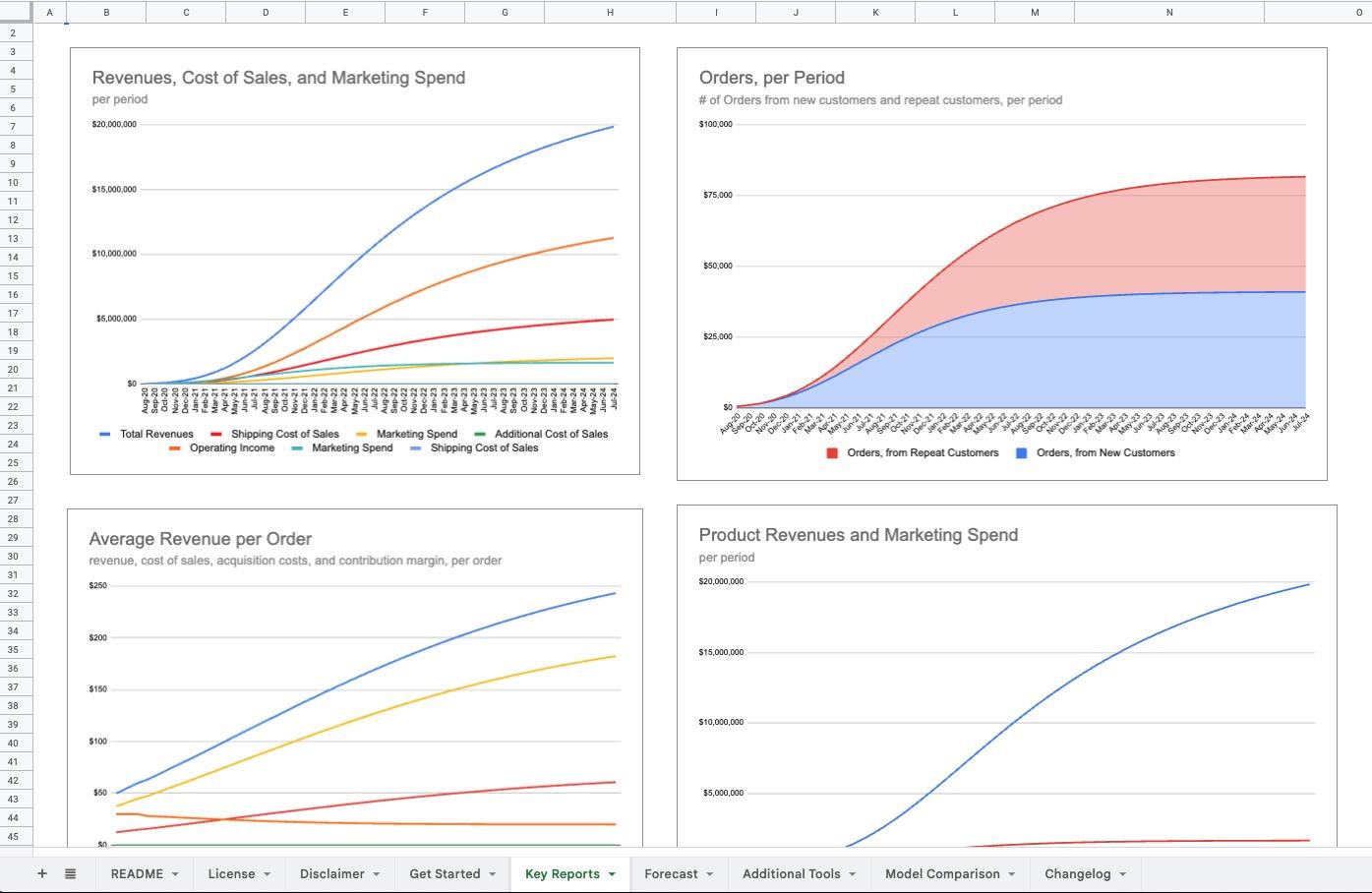

Ecommerce Forecasting Tool

revenue model only

Financial model template for ecommerce businesses. Operational assumptions - growth rate, repeat transaction rates, average revenues per order, customer acquisition costs - to create a revenue forecast plus key reports, including CAC, LTV, CAC payback period and more.

SaaS Forecasting Tool

revenue model only

Financial model template for a SaaS or subscription business for consumer, SMB, midmarket, or Enterprise SaaS. The model uses operational assumptions - growth rates, churn rates, average subscription, and more - and creates a revenue forecast plus SaaS reports such as MRR and ARR.

Unit Economics Tool

for per-customer analysis

Analyze fundamental unit economics by calculating margins, breakeven, and LTV (lifetime value, or customer lifetime value) based on inputs of recurring and transaction (one-time) revenues and cost of sales, churn rates, customer lifetime, and more.

Enterprise SaaS Forecasting Template

pipeline revenue forecast

Forecast an Enterprise SaaS, subscription, services, or consulting business by detailing a specific set of customers and contracts using an sales pipeline approach, to calculate bookings, billings, revenues and more.

Venture Capital Model, Rolling Funds

rolling funds specific

Simplified model for forecasting a Rolling Fund, to help understand overall venture fund assumptions and how portfolio construction impacts returns. Creates a quarterly and annual forecast of primary fund cash flows and metrics, as well as overall portfolio details.

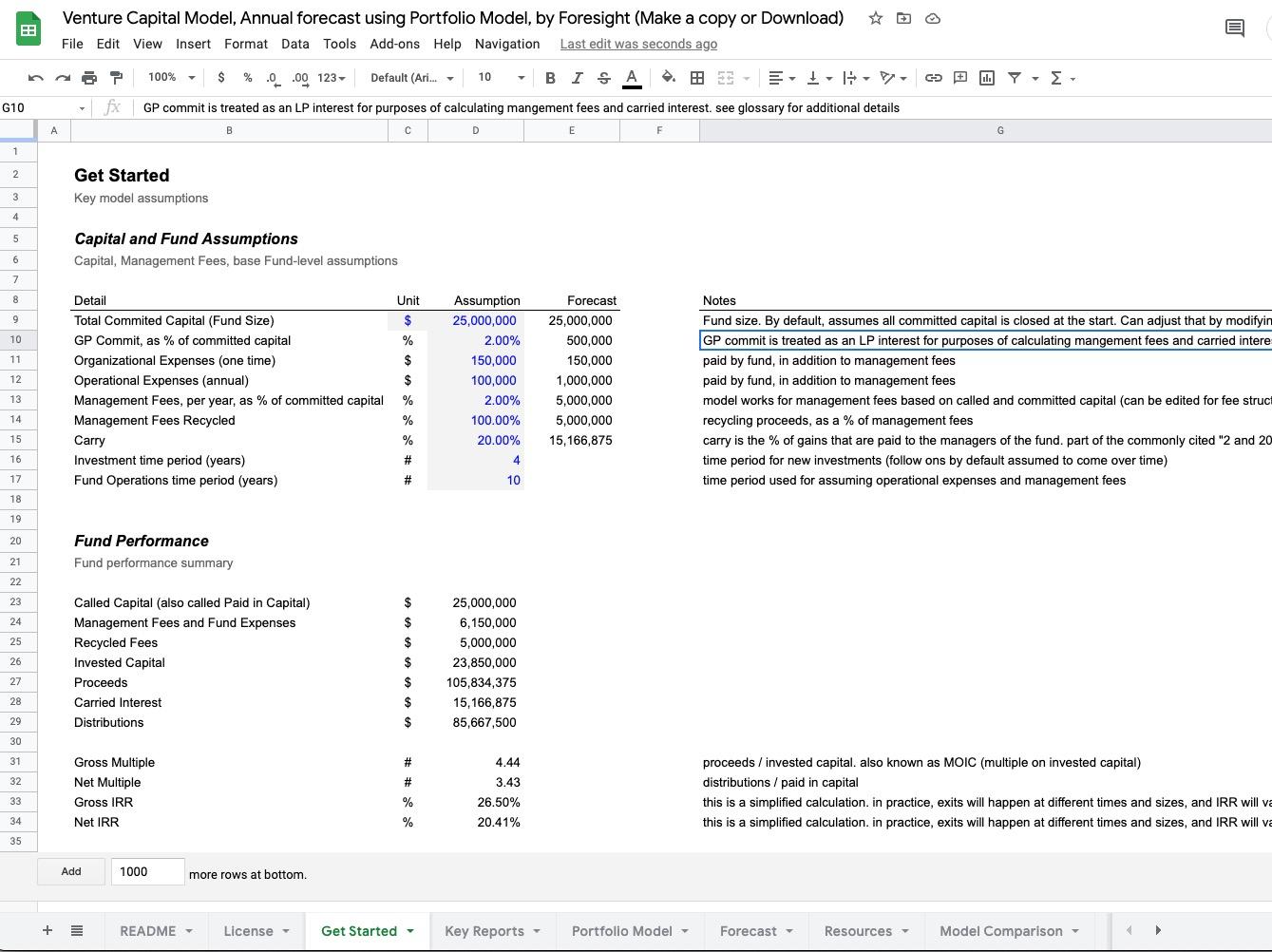

Venture Capital Model

simple annual forecast

Simplified model for forecasting a venture fund, to help understand overall fund assumptions and how portfolio construction impacts returns. Creates an annual forecast of primary fund cash flows and metrics, as well as overall portfolio details.

Venture Capital Model

manual investment input

Track historical and forecasted investments for an investment fund. Input specific or forecasted investments, follow-ons, valuation markups, writeoffs, and proceeds from exits. Creates an annual report of primary fund cash flows and metrics and overall portfolio performance.

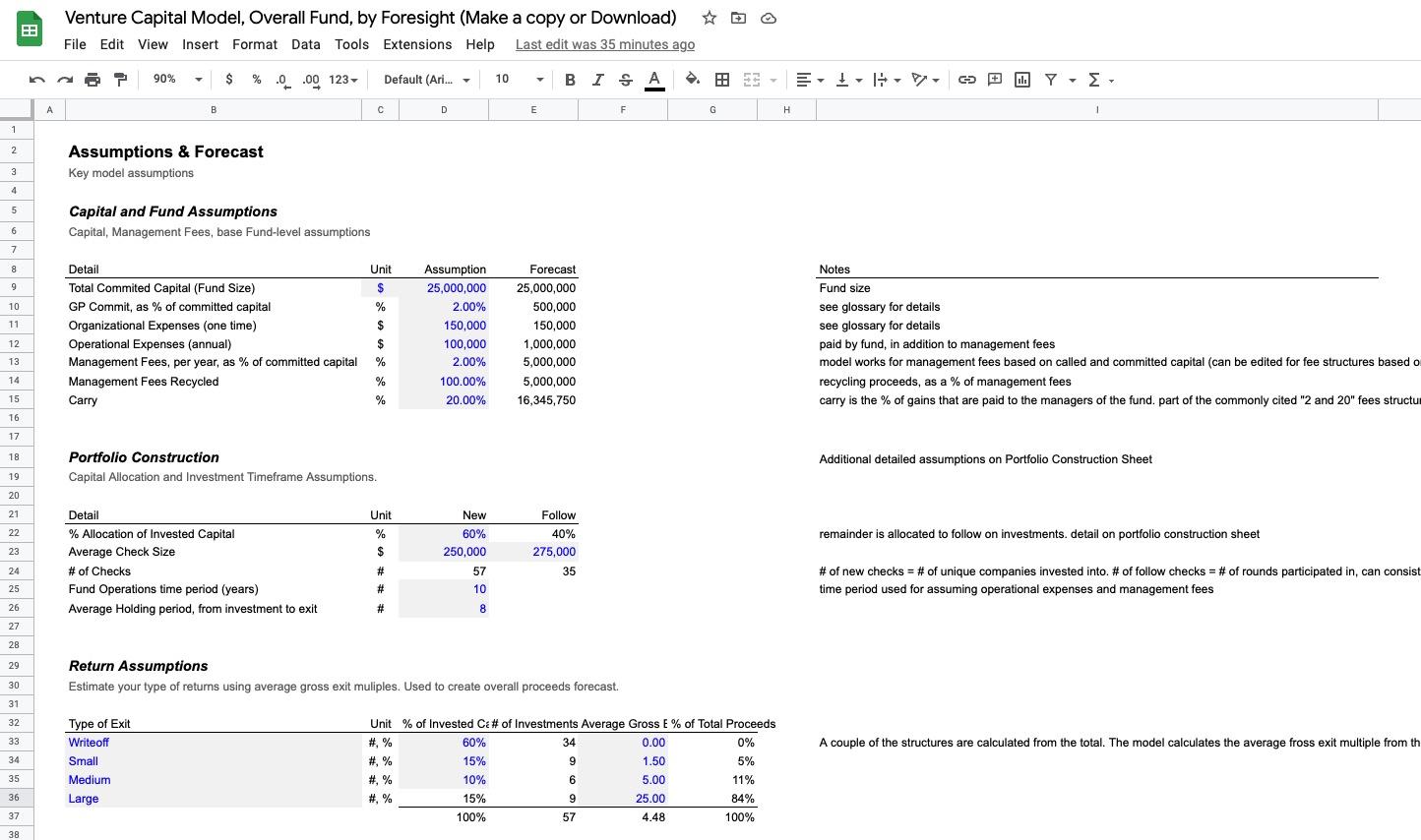

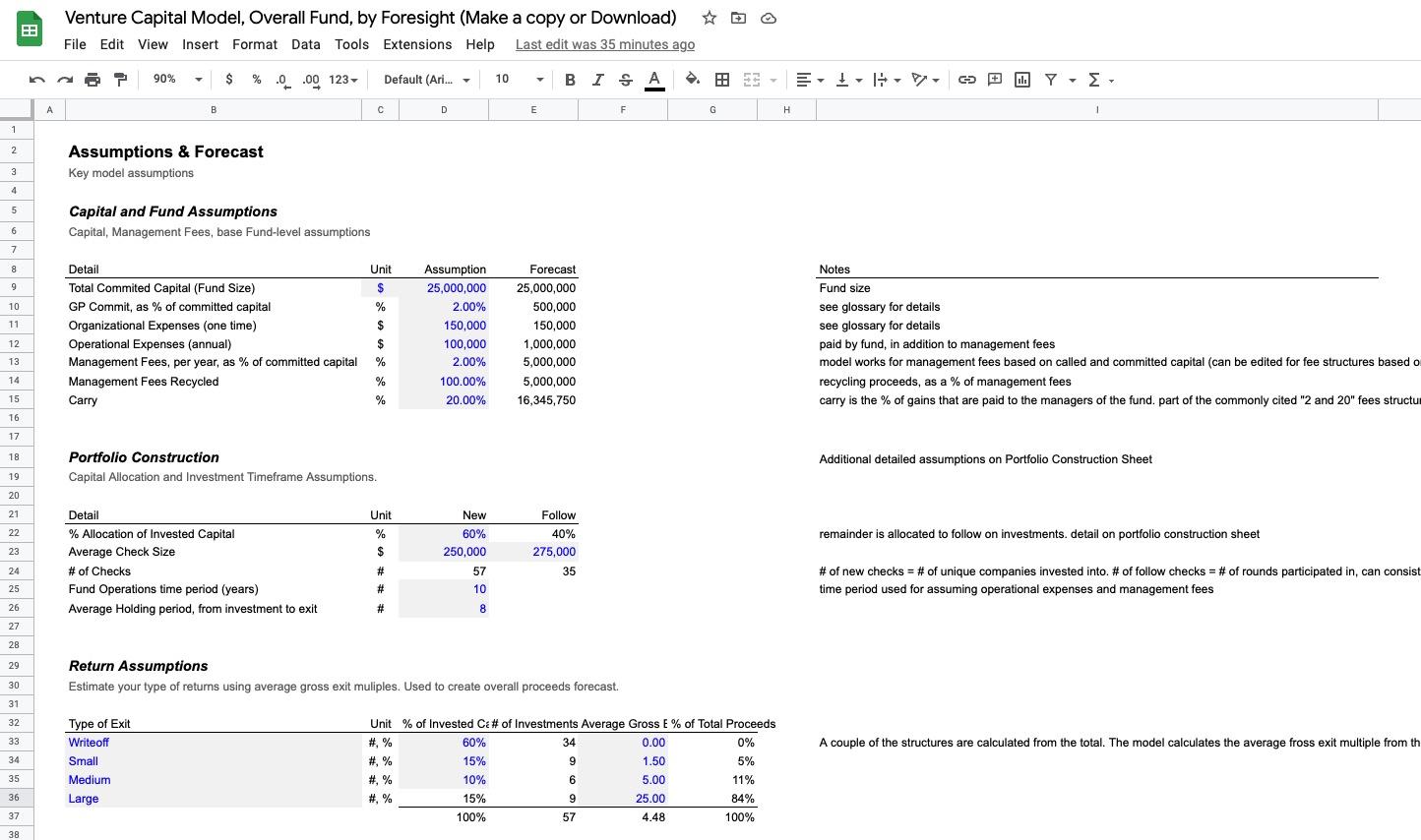

Venture Capital Model

overall forecast

Simple model for forecasting overall returns of a venture fund, to help understand overall fund assumptions and returns. Forecast total management fees and expenses to understand total invested capital. Basic approach to portfolio construction, creates a forecast of overall returns and multiple on invested capital. No forecast of cash flows, investments or proceeds over time.

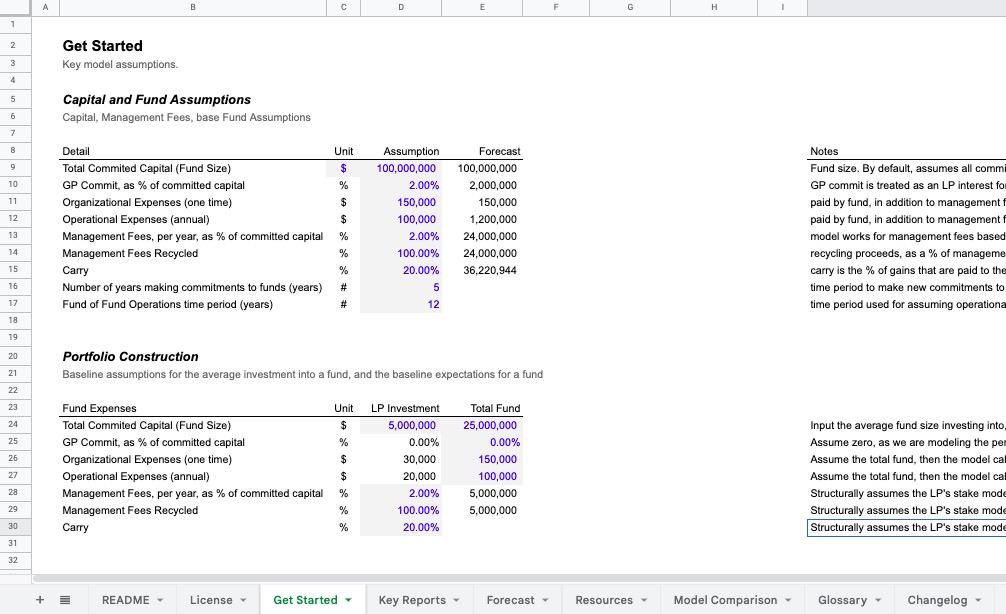

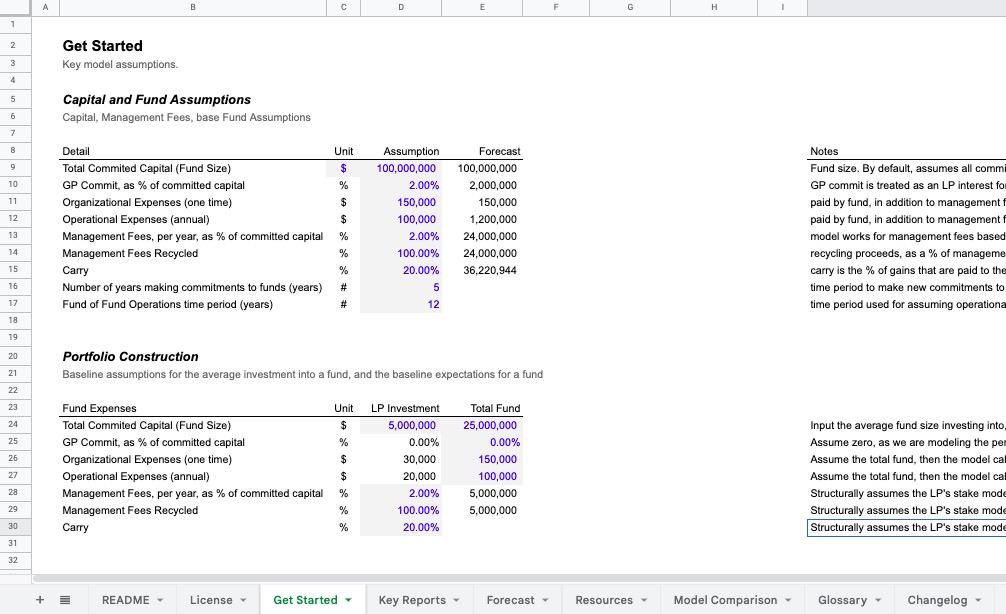

Fund of Funds Model

Model for forecasting a fund investing in venture funds, to help understand overall fund assumptions and how portfolio construction impacts returns. Creates an annual forecast of the cash flows and return multiples, IRR, and standard fund performance metrics.

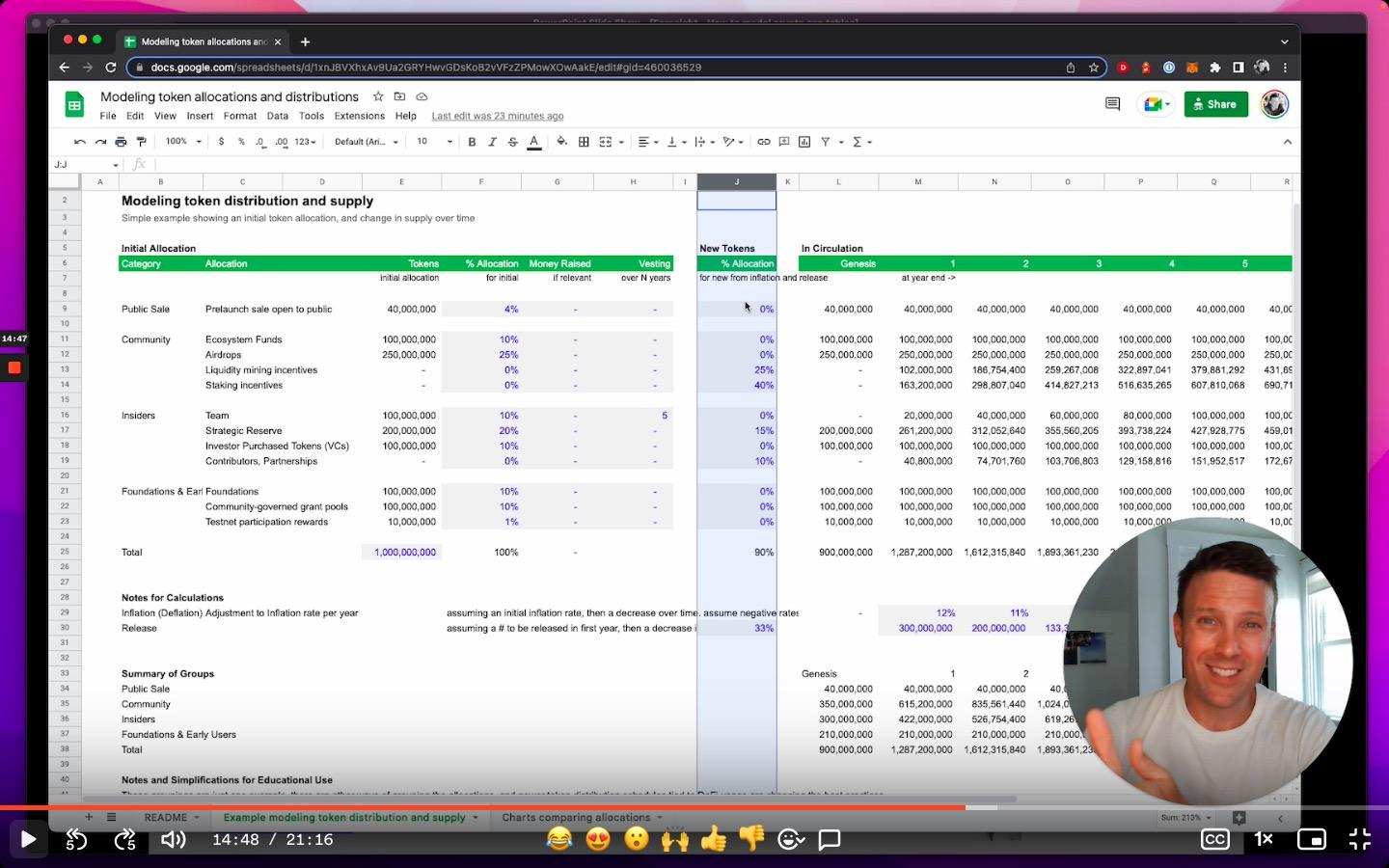

Token Allocation and Distribution Model

simple token analysis

Simple model to help translate tokenomics into a forecast of token allocations and supply over time.

Venture Valuation Tool

per investment analysis

Analyze venture investment opportunities by modeling potential investment rounds (via equity, convertible notes, premoney and postmoney SAFEs), dilution, graduation rates, exit valuations, and likelihood of exit at multiple exit prices to analyze valuations, portfolio construction, investor returns, and more.

Venture Capital Model

quarterly forecast

Simplified model for forecasting a venture fund, to help understand overall fund assumptions and how portfolio construction impacts returns. Creates a quarterly forecast of primary fund cash flows and metrics, as well as overall portfolio details for up to three scenarios

Venture Studio Model

studio plus fund

Simplified model for forecasting a venture studio using the dual-entity studio plus fund structure, to help understand overall fund assumptions and how portfolio construction impacts returns. Creates an annual forecast of primary studio cash flows and fund cash flows and metrics, as well as overall portfolio details.

Get Started Services

1 Hour Onboarding

Leverage your Foresight model and be prepared for business planning and investor conversations. Priority onboarding support, customization, and review of your financial model, based on my experience in reviewing thousands of financial models created by startups through Series B companies over the past decade. 1 hour screenshare or call, to review and edit your model.

Custom Models

for fundraising and budgeting

Custom services on a per-hour or per-project basis for complex financial modeling needs. I've built custom models for hundreds of clients since 2005 across a wide range of businesses, from ecommerce, SaaS, advertising, digital media, content, media, retail, gaming, in-app businesses, investment funds, and more, varying from pre-Seed, Seed and Series A funded startups to mature multi-million dollar businesses.

Access CFO

for Venture Investors

Strategic financial and operational guidance for venture investors without the full-time or fractional commitment. Get CFO-level expertise for your emerging fund on a flexible quarterly basis.

How to Model Venture Funds

self-paced course

6 hour self-paced course for angels, syndicate leads, and venture investors to learn how to model venture capital funds. Self-paced course, immediate access to course recordings, slides, instructional spreadsheets and extra videos

Cap Table and Exit Waterfall Course

self-paced course

9 hour self-paced course for founders, investors, and lawyers to learn the structures and math behind building cap tables and exit waterfalls. Immediate access to watch the course recordings and access instructional slides and spreadsheets. Also available as a <a href="/cap-table-masterclass/">cohort-based, live session masterclass</a>.